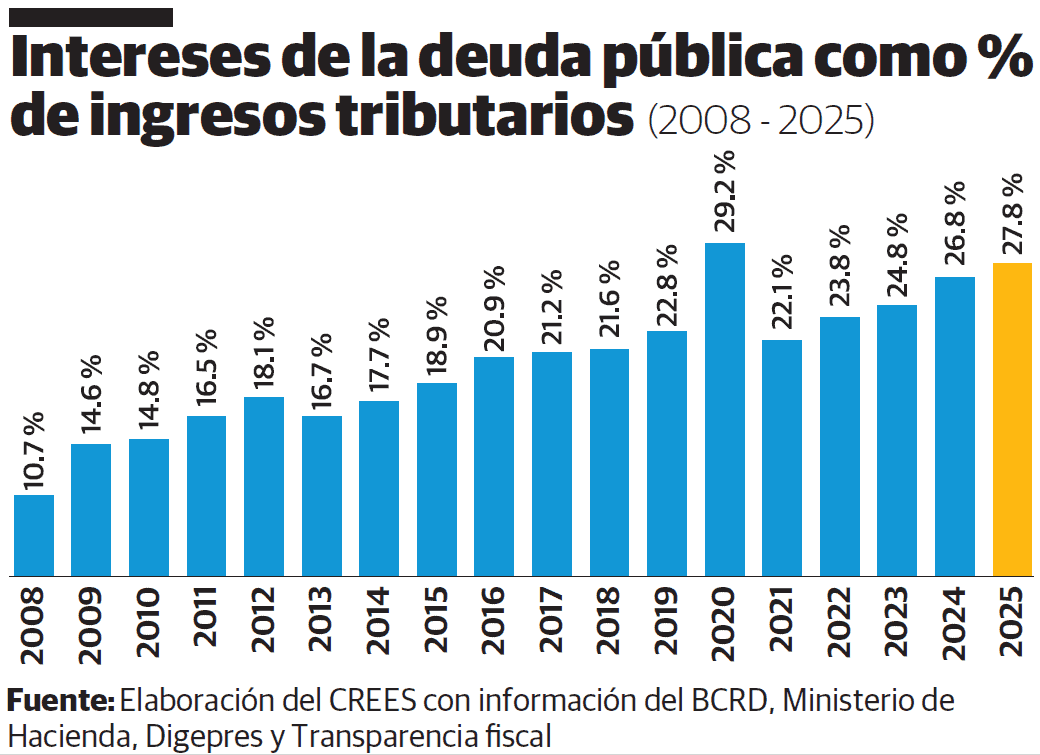

According to data from the reformulated 2025 budget, 27.8% of tax revenue of the Dominican Government will be used to pay interests of the public debt. In other words, for every 100 pesos that the State collects in taxes, almost 28 will be used only to cover interestswithout reducing the capital owed.

Although this percentage was slightly higher in 2020 (29.2%), that result responded to the exceptional drop in collections during the pandemic. The data for 2025, on the other hand, reflects a structural trend: the increasing weight of the cost of public debt on State revenues, even in a normal economic environment.

The analysis of the payment of interests as a proportion of the tax revenue It allows us to measure how much it costs the taxpayer to comply with the State’s obligations. Unlike debt as a percentage of GDP, this indicator more clearly reflects the pressure that debt exerts on public finances and on the resources that come from taxes paid by citizens.

image” type=”30″ title=”Click to edit placeholder“>

Behind this evolution there is not a lack of income, but rather a public spending that expands faster than the economy, which generates deficits that must be financed with debt. Each deficit translates into more debt, and each debt, into more interests that must be paid with citizens’ taxes. Ultimately, it is families and companies who assume the cost of a State that spends more than the economy can sustain without sacrificing its dynamism.

__________

A collaboration of the Regional Center for Sustainable Economic Strategies (Do you believe).