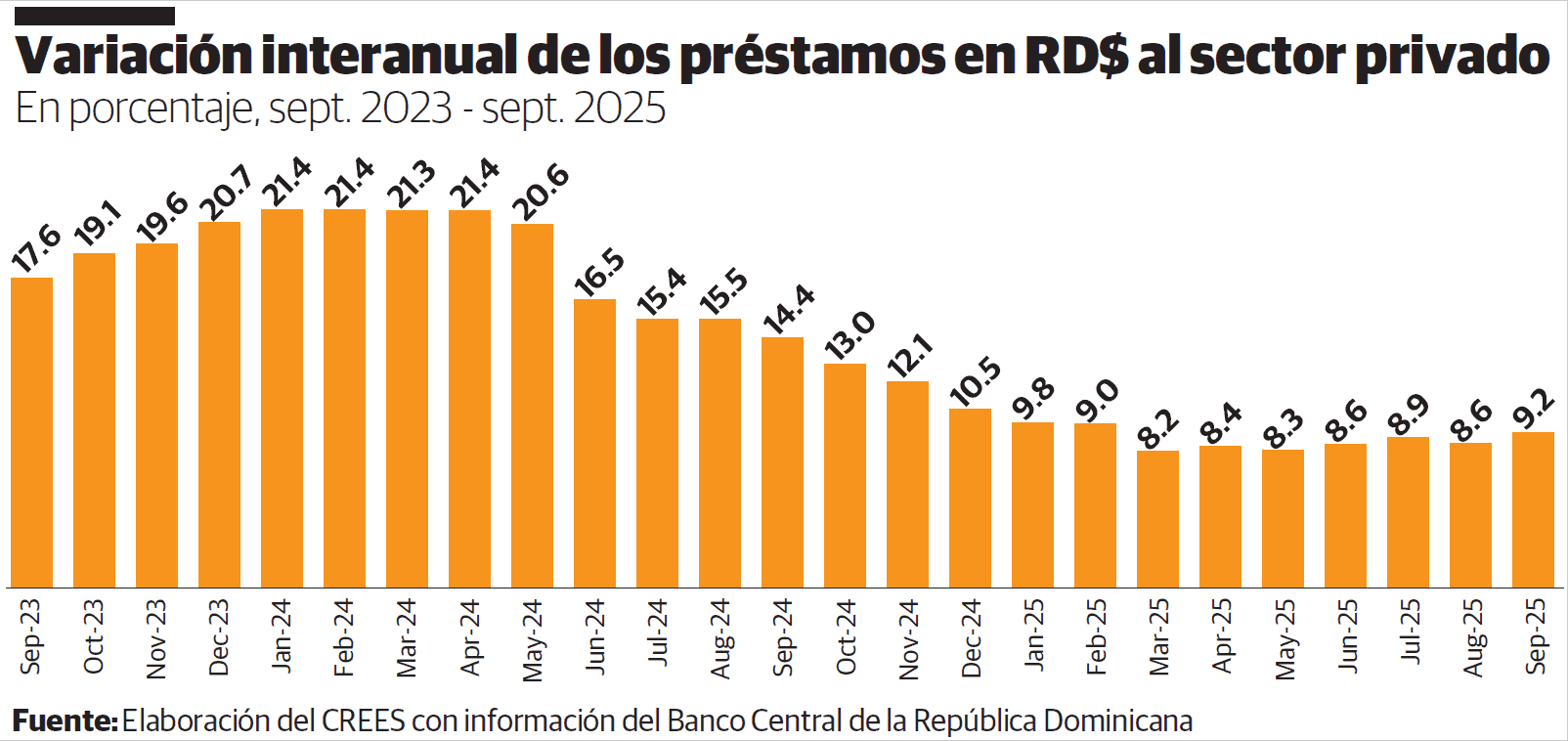

According to data from the Central Bank of the Dominican Republic (BCRD), at the end of September 2025 the credit to the private sector In national currency it reached a total of RD$1,927,878.8 million, while its interannual growth was 9.2%. An increase of 5.2 percentage points lower than the year-on-year growth verified until September 2024, which was 14.4%.

Among all loans, the largest proportion corresponded to those for consumption, which totaled RD$642,111.7 million; 33.3% of all loans to the private sector. This sector is followed by housing acquisition, with loans that totaled RD$407,663.3 million, corresponding to 21.1% of the total. Then loans to the sector follow trade with a total of RD$275,077.8 million, and a proportion of 14.3%. These three sectors represent 68.7% of all loans to the private sector.

Of these, the fastest growing sector was tradewhich grew 17.4% year-on-year; followed by home acquisition with 11.7%. In contrast, consumer loans experienced growth of 6.4%; continuing a decreasing trend that they have maintained since January 2024 when they reached 20.1%.

The trend in the decrease of credit private currency has been maintained since the beginning of 2024. The trend shows a reduction in the demand for credit for productive activities and for consumption. Despite the liquidity facilities granted by the monetary authorities, the conditions of the economy have not been favorable for a significant increase in productive projects. The Dominican economy shows a need for reforms to increase investments, production, increased employment and consumption.

__________

A collaboration of the Regional Center for Sustainable Economic Strategies (Do you believe).