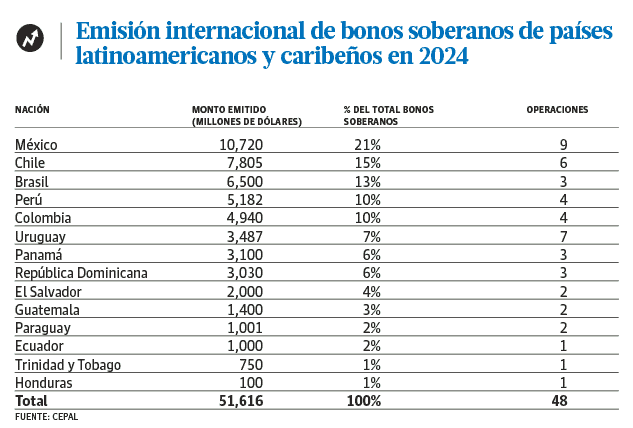

He Dominican state was the eighth largest emitter of sovereign bonds during 2024, among 14 Latin American and Caribbean countries, placing 3,030 million dollars in the capital markets through three credit operations.

Last year, 14 nations of the region they issued debt for 51,616 million dollars, through 48 issues, according to the report Capital flows to Latin America and the Caribbean 2024, review of the year and early developments in 2025.

The document, prepared by the Economic Commission for Latin America and the Caribbean (ECLAC), indicates that the emissions of the Dominican Government during 2024 represented 5.9% of the regional total.

-

Until last August, local authorities issued sovereign bonds in global capital markets for 2,538.4 million dollars, while in the domestic market the equivalent of 334.8 million dollars were placed in local currency, according to the records of the General Directorate of Public Credit of the Ministry of Finance and Economy.

Until last August, the dominican debt in bonuses amounted to 33,685.2 million dollars, equivalent to 76.5% of the debt external of the country. Likewise, it registered another 13,453.3 million dollars in bonuses in debt internal.

Mexico ($10.72 billion), Chili (7,805 million) and Brazil (6.5 billion dollars) were the three nations with the highest amount of debt in sovereign bonds placed last year, together representing 48.5% of the region’s total.

The report highlights the issuance of international bonds green, social, sustainability and linked to sustainability (GSSS) by Latin American countries in 2024, which increased by 6% compared to 2023, reaching a total of 33 billion dollars.

Within the nations that placed instruments of GSSS Last year there was Dominican Republicwhich issued its first green bond for 750 million dollars in June of that year at a rate of 6.6%, according to the study.

Among those at lower risk

The Dominican Republic closed last year as the eighth nation with minor country risk between the economies of Latin America and the Caribbean, with an Index of Bonuses of Emerging Markets (EMBIfor its acronym in English) of 206 basis points, only surpassed by Uruguay (84), Chili (117), Jamaica (150), Peru (157), Paraguay (161), Costa Rica (198), Guatemala (203) and Trinidad and Tobago (204).

The indicator continued to improve during this year, reaching 191 basis points as of last Tuesday, October 14, much lower than the Latin American average, which was 387.2 pointsaccording to Public Credit.