With the promise of replacing automatic debit and bills, automatic Pix becomes mandatory this Monday (13). Launched on an optional basis in June, the Pix extension was developed for the user to authorize periodic payments to companies and service providers, such as individual microentrepreneurs (MEI). The customer authorizes it once, with debits occurring automatically to the payer’s account.

The tool aims to benefit both companies and consumers. According to the Central Bank (BC), automatic debit will benefit up to 60 million Brazilians no credit card.

For companies, the new technology will make billing easier by simplifying adoption of automatic billing. This is because automatic debit requires agreements with each bank, which in practice was only possible for large companies. With automatic Pix, the company or MEI simply needs to ask the bank where they have an account to join.

How it works

- Company sends automatic Pix authorization request to customer

- In the bank or financial institution application, the customer accesses the “Automatic Pix” option

- Read and accept the terms of operation

- Defines the charging frequency, the amount (fixed or variable) and the maximum limit per transaction

- From the agreed date, the system automatically makes debits

- Billing can be done 24 hours a day, seven days a week, including on holidays

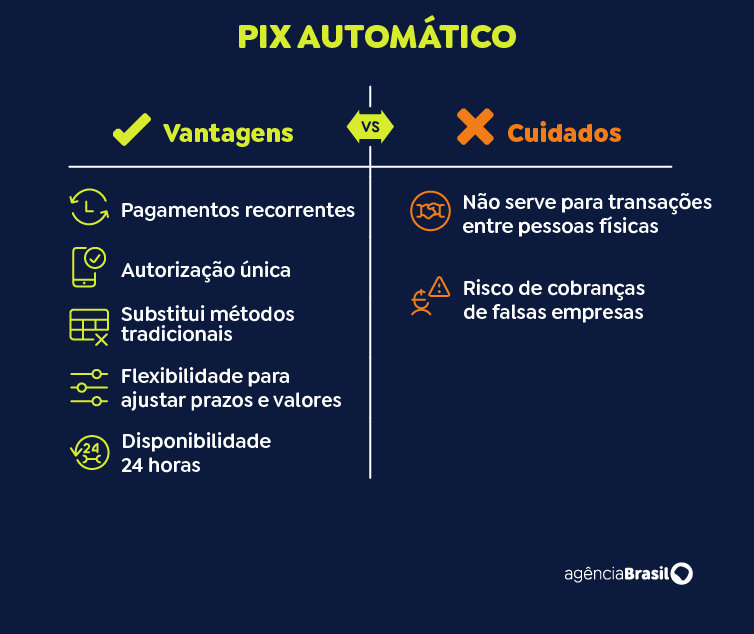

- User can cancel authorization and adjust values and frequency at any time

>> Follow the channel Brazil Agency on WhatsApp

Account types

Automatic Pix is only valid for individuals as payers and companies or service providers as collectors. Periodic payments between individuals, such as allowances or salaries for domestic workers, are made through another modality, the Recurring scheduled Pixa service that banks must offer since October 2024.

Some bills paid with automatic Pix

- Consumption bills (electricity, water, telephone)

- School and gym fees

- Digital subscriptions (streaming, music, newspapers)

- Subscription clubs and recurring services

- Other services with periodic billing

Some companies, mainly micro and small companies, used recurring scheduled Pix for periodic charges. Automatic Pix promises to simplify billing operations.

In recurring scheduled Pix, the payer had to enter the key with the company account, the amount and frequency of the charge, which could lead to errors and discrepancies. In automatic Pix, the user will receive a membership proposal, simply confirming the charge, being able to adjust amounts and frequency of payments.

Security

Automatic Pix brings some security risks. The main one is fake companies that send billing proposals that will go to third party accounts. To minimize the risk of scams, the BC published, in June, a series of rules for companies that join automatic Pix.

Banks and payment institutions must check a series of company information, divided into three axes: registration data, compatibility between economic activity and the service offered in automatic Pix and relationship history with the participant. To prevent fraud by newly created companies, only companies in operation for more than six months will be able to offer the new Pix modality.

The security rules that banks must check are the following:

- Date of registration in the National Register of Legal Entities (CNPJ); registration status of partners and administrators in the Individual Taxpayer Registry (CPF), and other company information

- Compatibility between economic activity and the service offered for automatic Pix

- Number of employees, value of share capital and revenue

- Account opening time and use of other billing methods

- Frequency of transactions with the participant