Page Seven / La Paz

Experts see the sale of gas to Peru as unfeasible due to lack of production, after the energy integration agreements signed over the weekend by authorities from both countries.

Within the framework of the VI Bolivian-Peru Binational Cabinet, held on Saturday, the Bolivian Minister of Hydrocarbons and Energies, Franklin Molina, signed with his Peruvian peers four energy integration agreements that project the export of liquefied petroleum gas (LPG) , liquefied natural gas (LNG), the installation of gas networks and the promotion and marketing of Bolivian urea in the neighboring country market.

One of the agreements aims for Bolivia to build a gas pipeline that allows it to take LNG to the south of Peruvian territory and a natural gas liquefaction plant so that the Plurinational State can export LNG to Peru and other countries from that strategic point.

Álvaro Ríos, former Minister of Hydrocarbons, said that until 2024 there will be surplus LPG and if there is no place to store the production, it should be exported to Peru and Paraguay at market prices to private companies.

The government of the neighboring country is interested in increasing the consumption of natural gas, but for Bolivia it is a small business if it builds networks or sells LPG in trucks, he added.

“In the case of LNG, having several buyers in Brazil at high prices, why would we have to send gas to Peru when there is neither infrastructure nor gas pipeline? Brazil and Argentina require gas, but we don’t have it in the volumes that they demand, so how to send it to Peru ”, questioned the expert.

He stressed that there is not enough gas production and the country is 10 years away from starting to import at the current rate of export and domestic consumption.

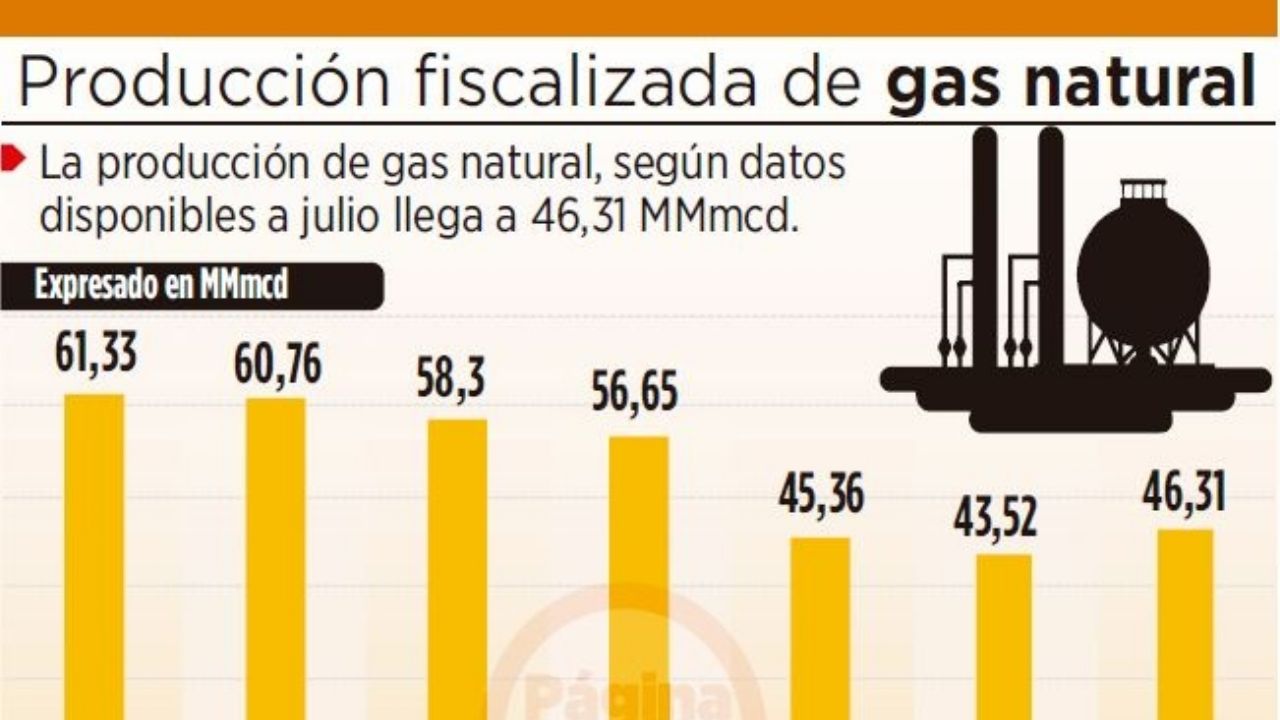

Official data from the Ministry of Hydrocarbons show that in 2014 the country produced 61.33 million cubic meters per day (MMmcd), last year that dropped to 43.52 MMmcd and in July of this year 46.21 MMmcd was achieved.

The analyst Hugo del Granado explained that to export gas and build a liquefaction plant requires millionaire investments and that the country can guarantee a volume of 30 MMmcd for 30 to 40 years.

This requires a gas reserve of at least 10 trillion cubic feet (TCF), which is also not available.

He explained that the gas would have to go from the Rio Grande plant in tankers to the Peruvian coast, but it would not be competitive due to transportation costs.

The other possibility is that the gas reaches Senkata and from there take it to Peru, but for this the capacity of the gas pipeline to the altiplano would have to be expanded, which only supplies the demand of La Paz and Oruro.

“But the main thing is to have the 30 MMmcd of gas and the reserves insured. If you don’t have that, it is absurd to undertake such a large investment to build a liquefaction plant on the coast to export to Peru and other countries with methane tankers. Talking about these two ways is absolutely unfeasible ”, he remarked.

In the case of LPG exports, Del Granado pointed out that they can be shipped in tanks from the Senkata plant.

On the other hand, to build gas networks in southern Peru, Yacimientos Petrolifos Fiscales Bolivianos (YPFB) must first win a tender.

“It is not that the ministers of Peru and Bolivia sign and it is awarded directly to YPFB. If the state company is competitive, it will win and it will have to build the networks and buy gas from Petroperú and the private operators, ”he clarified.

- Agreements

- Agreement According to the Ministry of Energy and Mines of Peru, “studies will be developed to determine the technical and economic feasibility of interconnecting the project to build a gas pipeline to the south with a possible pipeline in Bolivia.” In this way, according to that government portfolio of the neighboring country, “Bolivia will be able to develop a natural gas liquefaction plant in the port of Ilo to export it and supply the Peruvian market.”

- Means This year the Ministry of Hydrocarbons projects that natural gas production will grow to 47.39 MMmcd. But this level does not compare with the production record reached in 2014 with 61.13 MMmcd.