Beyond generating increasingly personalized experiences for users and giving a faster and faster response to claims that arise with the use of Payment systems digital, the integration of models of artificial intelligence generative (AI) contribute to the bank to reduce and prevent cases of cyber fraud.

Indeed, AI adds “a Additional protection layer”To online transactions when expanding the Tokenizationa technology that replaces real financial data with a unique, unrepeatable and temporary code that allows to validate the operation without exposing or revealing the financial data of the users.

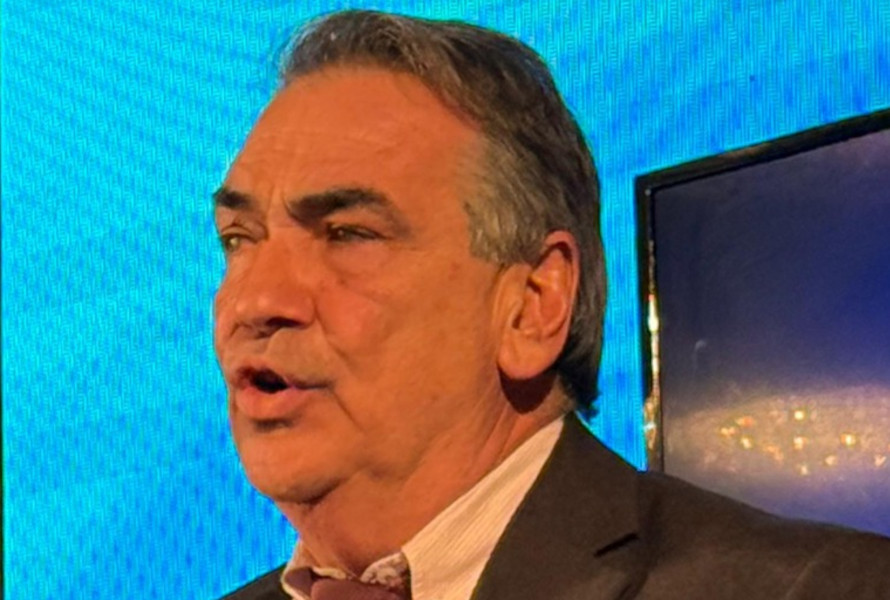

It has been proven that the Tokenization reduces the Fraud financial in more than 30 % in Payment systems globally, according to the country manager of Visa in Dominican RepublicGustavo Türkiye.

“Saying it in another way, the Tokenization It will have the same effect for the world on-line than the chip had for the physical world (…) will increase authorization levels (transactions), ”added the vice president of the consulting area of Visa In Latin America, Rodrigo Santoro.

Both executives considered that this becomes special importance in the Dominican Republicwhich is the seventh country in Latin America in which the use of the artificial intelligencea technology that is already implementing the Digital Bankingaccording to AI Readiness Index conducted by the University of Oxford.

OPPORTUNITY FOR DIGITAL INCLUSION

Türkiye pointed out that this has been possible thanks to the fact that the country has an expanding digital environment, with 80 % of citizens using smartphones and in which 86 % of cardholders Visa implements Contactless paymentsso there is already a created digital environment that encourages the formalization of small and medium enterprises (SME).

He also recalled that Visa He has contributed to the government through the Supérate program, which defined it as “a case of global success” in the Subsidy distributionbecause the same card has “more than ten different pockets” for the delivery of food, gas or energy bonds.

“There is an (artificial) intelligence behind the card that provides financial inclusion”He stressed.

He indicated that the company has also created the INCO platform Visawhich seeks to educate, include and help Entrepreneurs To have a better management of your business, as part of the contributions to the reduction of the informal economy in the country.

Visa celebrated an immersive day of artificial intelligence (Visa Ia Immersion Day, in English) with the aim of sharing, both bank customers and acquirers of the Fintech, the advances of AI in the financial system, what are the main trends and how to implement this technology increasingly in financial services. The event was focused on knowing the advantages of artificial intelligence, based on:

-

Take advantage of the hyperpersonalization that AI allows to improve user experience

Optimize operational processes with this tool

Generate better satisfaction in users.