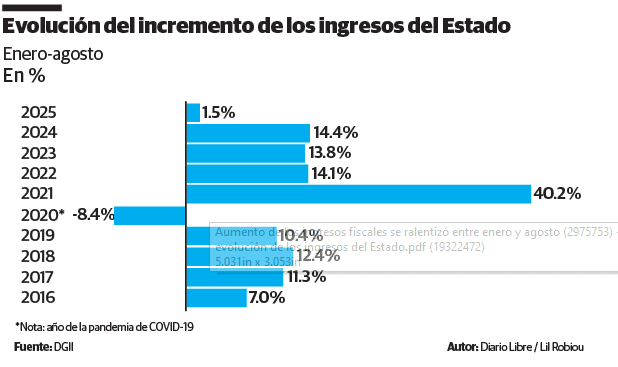

State income growth suffered a slowdown During the January-August period of 2025 at levels never registered, at least during the last 10 years, excluding the 2020, a period in which the pandemic of COVID-19 It affected the world and local economy.

In the first eight months of this year, the collections of collecting offices only They increased in 1.5 %, in relation to the same period of the previous year, according to the records of the General Directorate of Internal Taxes (DGII).

The different collection analysis reports, which prepares the DGIIthey reflect that during the aforementioned period there were GROWTHS in the Fiscal income that They ranged Between 7 %and 40.2 %, excluding January-August of 2020, when it registered a fall of 8.4 %.

Although the report of collection of the DGII corresponding to last August does not quote possible causes of the deceleration of the growth of the revenue of the treasury, the document collects the low economic growth of the country, which between January and July was 2.4 %.

Between January and August of this year, the COLLECTORS They charged 808,079.1 million pesos in Taxes or services for services, equivalent to 11,632.2 million compared to the similar date of 2024, although the figure represents a compliance of 100.7 % in relation to the estimated in the budget.

-

The January -2025 collection showed a positive performance, reflecting an improvement with respect to the same period of 2024. This positive behavior is observed in the main taxes that presented the highest absolute growth, such as the tax on the income of the companies and that on the assets, that of mining and the income tax of the natural persons, the document stands out.

And he adds that, as for the Collection goal For January – August 2025, a compliance of 101.4 %, equivalent to 8,562.4 million pesos above the budgeted.

Below

However, 19 tax concepts10 of them They raised less of the estimated amount, including the Tax on Transfers of Industrialized Goods and Services (ITBIS) for which 155,344.3 million pesos was projected and had a collection effective of 145,096.8 million, resulting in a negative balance of 10,247.4 million pesos.

Also, the collections for the selective taxes on fuels and alcohols and tobacco They were below the estimate at 5,390.3 million pesos and 2,360 million, respectively.

-

State sales encumbrances (2,865.7 million pesos), Marbete, first plaque, CO2 (carbon dioxide) and vehicle transfer (1,161.6 million pesos), tourism and passenger card (940 million pesos), among others, are part of the taxes whose collection between January and August did not comply with the amount estimated by the authorities.

In total, the 10 types of Taxes They stopped contributing 24,982.8 million pesos to the treasury of the projected amount in the General State Budget.

Above

On the opposite side, nine Taxes contributed incomebetween January and August 2025, above its estimates, highlighting the Business Income Tax and the Tax on assetswith 15,751.3 million pesos, followed by mining contributions, whose collection He exceeded at 9,144.2 million pesos the projections for the period.

“He mining tax registered remarkable growth, reaching a collection in January-August 2025 of 19,816.3 million pesos, which represents an absolute increase of 12,038.2 million more compared to January-August 2024. This growth is explained by the Increase in the price of gold And the efficiency in production costs, “highlights the document.