The Monetary Board approved a series of measures that seek to maintain the exchange market stability Before the sudden rise of the dollar ratedecision that has not taken expectations between actors linked to the sector or that are impacted, of some measure, by the volatility of the exchange rate In recent days.

This has been the case of unions such as the Dominican Association of Exchange Intermediaries (Adocamous) and the National Association of Vehicle Distributor Agencies (Anadive), who considered the decision accounted for a rate that, in a few days, exceeded the barrier of the 64 pesos for each unit.

As an entity that groups agents and operators of the currency market, Adocamous He pointed out that the information received so far on the piece – which has not yet been published by the Central Bank– They are positive, and said they have “high expectations” about their content, especially in relation to the Higher transactions at 10,000 dollars or 10,000 euros, which must be registered on the electronic platform of the Central Bank.

“The standards and instructions that can be repealed after the approval of this modification to the exchange regulation will be favored to the users of the currency market; They will affect each Dominican and translates into a good image of our country internationally, “the guild pondered.

As Importer sector who handles currencies, Anadive The measure understood, in a context in which dollar increases “Import increases, inflation presses, sales and They affect the cost of external financing for companies and the State itself. “

- “Keep the dollar rate Within the acceptable parameters it is a priority, avoiding the speculation and possible Inflationary effectswhile guaranteeing stability, sales and tax revenues, “he emphasized through a press release.

Stop “speculation” with the currency

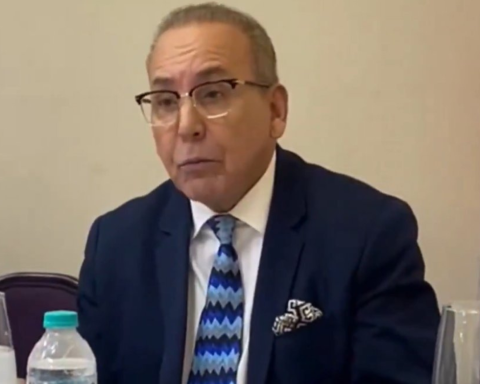

For him Economist Nelson Suárezthe country’s monetary and banking authorities “seem to have evidence and certainty” that the dollar volatility has been influenced by deliberate actions of financial intermediation entities and exchange intermediaries, so it has resorted to impose more control in transactions.

Although the Dominican weight It is usually depreciate at a rate of 5.00 % annual compared to dollarin just five months a accumulated rate of devaluation from 3.52 % – passing from 60.94 to 63.09 pesos the unit–.

Between the months of April and May there was a revaluation of 5.04 % of the weight against dollarplacing the exchange rate in 59.15 pesos average.

However, only between September 5 and 9 was the 63 pesos barrier over dollar – even at 65 pesos in some operations -, which quickly alerted the authorities.

In that sense, Suarez observed that measures of the Monetary Board They seek to stop any “speculative movement“That could be caused by the Injection of 81,000 million of pesos to the economic sectors through the legal lace in June 2025, with the aim of maintaining the dynamism in the face of the deceleration of the growth of the economy.

Impact on final consumers

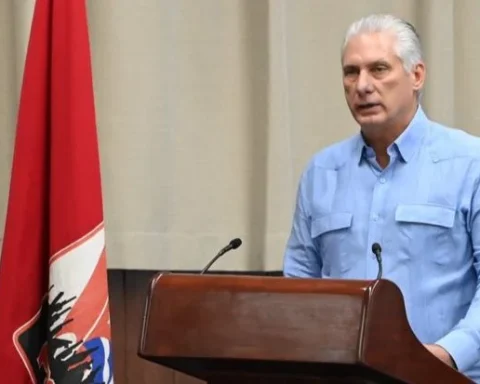

This coincides with Economist Antonio Ciriaco Cruzwho saw the measure as a way to reinforce the Transactions control and ensure most of the Dominicans who, by receiving their income in pesos, are the most affected by the Fluctuations of the currency.

He explained that, if these were not taken measuresa indirect transmission in the Basic basket pricesdue to Imported components with which there are such essential products for the Dominican diet, such as chicken.

Indicated that when the Central Bank facilitated the LEGAL LACE RESOURCES I was looking to reactivate the economy, but this too increased capacity From the economic sectors of importing more products those that, when marketed in dollars, vary the dynamics of the currency market.

“There is an indirect impact on the exchange market because it is already known that it will see a greater demand And that makes the exchange rate I tend to go up, and that is He immediately reflected“He said.

Understands that it is a measure that seeks to avoid “any unwanted situation” with the dollar in it internal marketin a context in which the Dominican economy will have a Minor expansion to the initially projected.