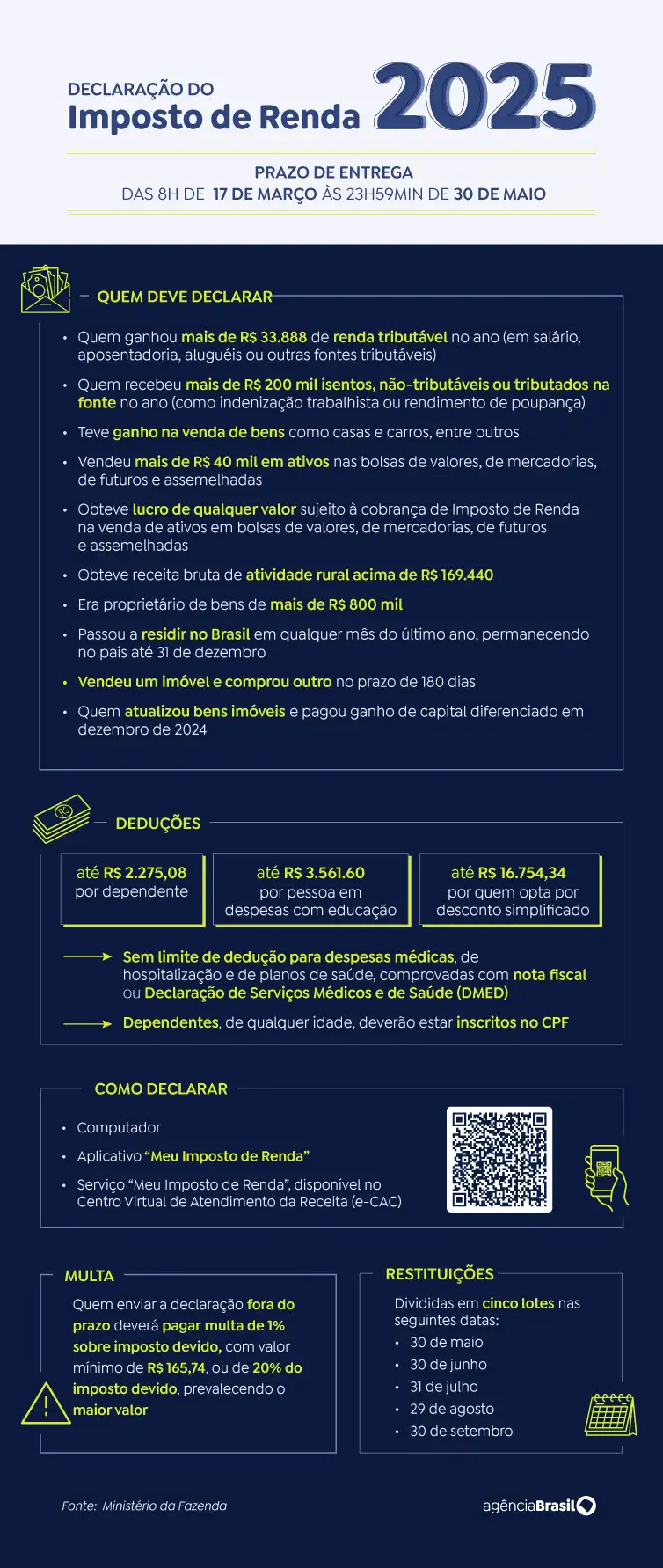

From 10am this Friday (22), about 1.9 million taxpayers who delivered the declaration of this year’s Individual Income Tax will get the accounts with the lion. At this time, the IRS will release the Consultation of the five of the five refund lots of 2025. The lot also includes residual refunds from previous years.

In all, 1,884,035 taxpayers will receive R $ 2.92 billion. Most of the value, the tax authorities said, will go to taxpayers without priority in the reimbursement, who declared close to the end of the deadline.

The refunds are distributed as follows:

- 1,454,509 taxpayers without priority;

- 312,915 taxpayers who used the pre-named statement and/or opted simultaneously for receiving refund via Pix;

- 72,434 taxpayers from 60 to 79 years old;

- 22,841 taxpayers whose largest source of income is teaching;

- 13,515 taxpayers over 80;

- 7,821 Taxpayers with physical or mental disabilities or serious illness.

Although they have no priority by law, taxpayers who used two procedures together, pre-named and pix, have priority to receive refund this year. However, most refunds to this audience were paid in the previous three lots.

The consultation can be made in the IRS Page on the internet. Just the taxpayer click on “My Income Tax” and then the “Consult Refund” button. It is also possible to consult the IRS app for tablets and smartphones.

The payment will be made on August 29, in the account or Pix key of the type CPF informed in the income tax return. If the taxpayer is not on the list, he /

If, for some reason, the refund is not deposited in the account informed in the statement, as in the case of disabled account, the Values will be available for redemption for up to one year at Banco do Brasil. In this case, the citizen can schedule the credit in any bank account in his name, through the BB Portal or calling the bank’s relationship center at 4004-0001 (capital), 0800-729-0001 (other locations) and 0800-729-0088 (exclusive special telephone for hearing impaired).

If the taxpayer does not redeem the value of his refund after one year, he / she must request the value on the E-CAC portal. Upon entering the page, the citizen must access the “Declarations and Demonstrative” menu, click “My Income Tax” and then in the field “Request refunded refund in the banking network”.