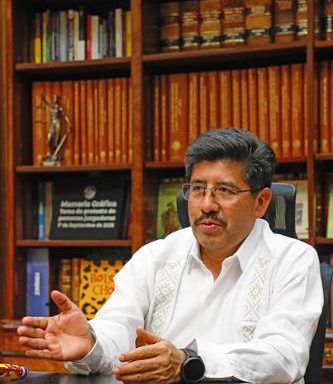

Low adjustments mainly obey the objective of reducing the budget deficit, which is achieved with higher income, which have not been completely favorable especially due to the fall in oil revenues, while, although the tributarians have grown by ISR and VAT, the IEPS comes below what is approved, then there is also to make reductions to the expenses that have been seen in these branches and in social programs, explained José Luis Clavellina. Research from the Economic and Budget Research Center (CIEP).

According to the Treasury, the general cut to public spending was 286,885 million pesos, of which 281,076 million were for programmable spending, which refers to budgetary resources to meet specific objectives and goals of government programs and projects.

“An also relevant part of the adjustment is being carried out by physical investment and financial investment,” said CIEP research director.

They are Justo Pemex and the Ministry of Infrastructure Communications and Transportation (SICT) two agencies that are in the first 10 organisms with downward adjustments in their programmable expenses, said Treasury, specifically due to minor expenditures in physical investment, general services and materials and supplies for the oil company, and in the case of the SICT it is for the non -exercise of expense in the provisions for the development of passenger trains and Load, equally for the development, modernization and rehabilitation of infrastructure, and lower resources for municipal connectivity.

“This will have repercussions itself, in economic growth, in collection, but also immediately at the standard of living, because they access public goods and services, and then there is less investment, in virtually all items, which reduces the quality of these goods and services,” he considered clippled.

He explained that the variations in spending for social programs also depend on changes in the age and school degrees of people who favor them, for example, young students enter the labor field, or rise in school degree; While older people have deaths, then the beneficiaries records are updated.

More for IMSS, Customs Control and Migratory Services

Meanwhile, IMSS, Treasury, SRE, Government and CFE register amounts for amounts from 1,034 million pesos to 4,388 million, no matter how much expense in pensions, greater customs control, more resources for consular and migratory services, and higher material spending and supplies for CFE.

Clavellina explained that the largest expenses for pensions are due to the aging of the population, which is one of the expenses that grow the most in the public sector. In the first semester, the expense for pensions and retirements of the public sector grew 8.4%.

Although in the total and by function, the Treasury reports less growth in its expenditures, it received 3,659 million pesos more than the design and application of economic policy; for the regulation of the financial sector; and for the control of the customs operation. The current administration has concentrated on strengthening mechanisms and application of customs in customs after, the objective of increasing the arrival of resources to public coffers, and for the following year it provides for a reform to the customs law.

While the United States antimigration policy and migration to Mexico, it has required greater consular and migratory services.