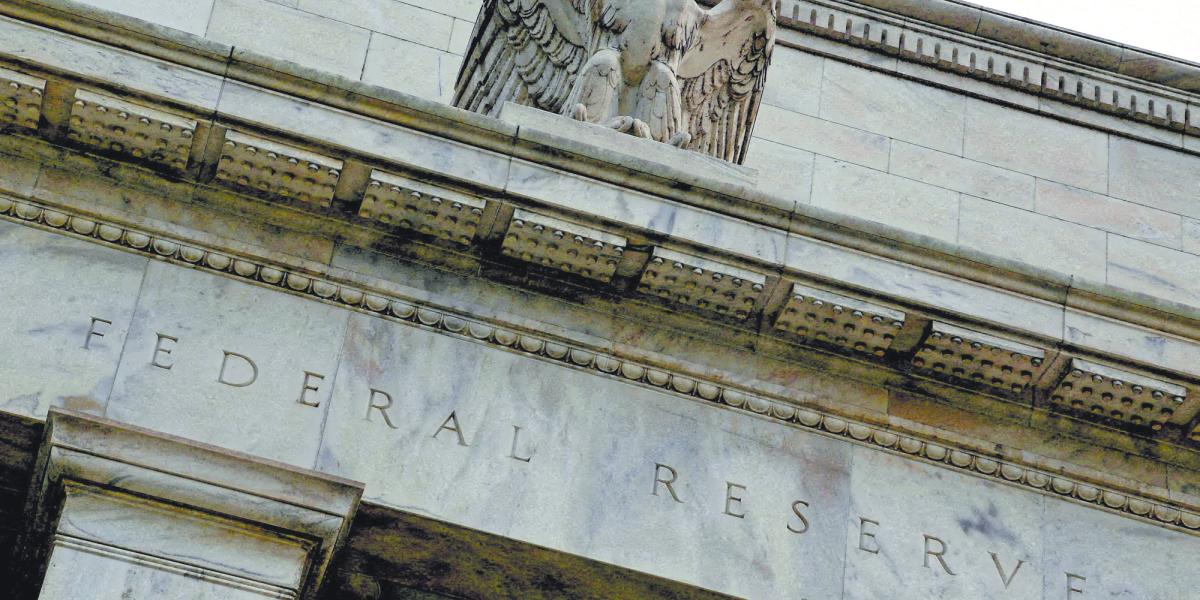

Will the Federal Reserve (FED) achieve the pressure of the US President, Donald Trump, who wants a feature of fees? For most analysts there is no doubt that there will be no changes in this week’s meeting.

The decision should be known on Wednesday, and the president of the Central Bank, Jerome Powell, will immediately offer a highly anticipated press conference.

“I want the rates to go down,” Trump reaffirmed on Thursday, visiting the remodeling works at the Federal Reserve headquarters with Powell, after a tense exchange between them.

It is a message that the president has repeated for weeks without hiding his frustration: he came to nickname the head of the Fed as Powell “too late” and accused him of acting “against” the US economy.

For the US president, the decline must be massive, of three percentage points, which would place interest rates between 1.25 and 1.50% per year. That would reduce the burden of public debt interests.

Donald Trump even threatened, in mid -July, to say goodbye to Powell reproaching him the cost of the remodeling of the Fed, estimated at 2.7 billion dollars.

Finally, he would have resigned from this idea after a conversation with the Treasury Secretary, Scott Besent, according to the Wall Street Journal.

Besent, however, kept the pressure when asked on July 21 if the institution has been “effective.”

In waiting

The signals sent by the main responsible of the Fed point to keep the fees again at their current level, in a range between 4.25 and 4.50%, during the meeting of their monetary policy committee (FOMC) scheduled for Tuesday and Wednesday, this week.

Inflation persists above 2% per year, which is the objective of the FED, in particular, as Powell stressed, due to the consequences of Trump tariffs.

According to the CME Group monitoring tool, known as Fedwatch, investors do not anticipate rates before the next September meeting or even the one that follows.

“The FOMC will leave the rates without changes during its next meeting. But it will be interesting to see if Powell refers to a possible flexibility of monetary policy before the end of the year, or if he tries, on the contrary, to avoid giving indications,” said Gregory Daco, chief economist of Ey-Parthenon, in an analysis note.

The extension of a pause in the rates cuts that are present since the beginning of the year does not have unanimous support among the members of the FOMC. Some, such as Christopher Waller, have expressed their conviction that it is time to act.

“I will try to convince them of the importance of my position. In the end we will make the decision we consider better based on the data we have,” said July 18 in Bloomberg TV.

Independence, essential

The pressure on the governor of the Fed, Jerome Powell, has been evaluated in various ways by investors, for whom the independence of the institution regarding political power remains essential.

And the idea that Trump seeks to fire Powell weighed in the markets, before the president said that this possibility was “unlikely.”

“Jerome Powell was able to verify that the government launched a probe balloon (but) that showed that the markets give importance to the independence of the Fed,” said Ryan Sweet, chief economist of Oxford Economics.

The market actors will be attentive to the opinions of those members of the FOMC who, as Waller, can express a divergent opinion, and above all – if this happens – how many will do it.

For Sweet “There are cracks but they have not yet been transformed into fractures.”

During his interview, Christopher Waller highlighted the signs of weakness in private employment and expressed his fear that, if acting too late, the labor market ends up being affected with an increase in unemployment.

The Fed has two mandates: control inflation and ensure full employment.