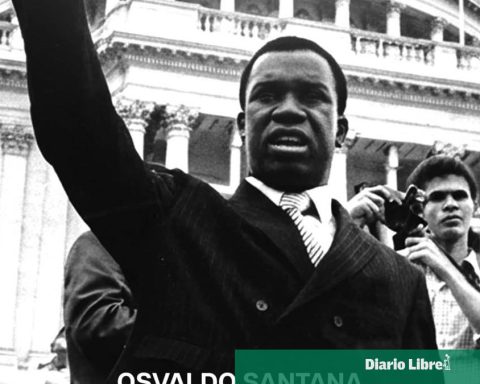

The pension funds In the Dominican Republic, far from becoming a lever for national productive development, they have ended up mostly anchored to public debt, a situation that concerns the economist and former Minister of Economy, Isidoro Santanadue to the excessive concentration of these funds in state debt instruments.

He warned that this dependence on state financing has obvious risks, especially, in the absence of tax reform. “As the funds enter their maturation period and you must start paying pensions, it will be the State who must seek resources.” It will have no more options to return them, but the budgetary problem will be aggravated, “he warned in an interview with today.

Can read: Eddy Olivares states that the dismissal remains in the Labor Code: “It is a culture”

He explained that the economic and social risks will be presented to the extent that more people are pensioning and the aging of the population is deepened. “In countries with a very aging population, pension systems enter into deficit and no more than face costs by taxes,” he said.

According to data from the Superintendence of Pensionsabout 70 % of the funds administered by the Pension Fund Administrators (AFP) are in public values, in the Central Bank and the Ministry of Finance.

Santana commented that in the time of discussion of the creation of the Social Security System, prior to 2001, the country would be expected to develop a broad stock market, in which productive companies could finance their investments with these funds, guaranteeing profitability, at the time of promoting the country’s economic development, but that has not happened.

He indicated that today there is the problem that there are not many alternatives to invest pension funds and, such as competition in the financial market, translates into very high real interest rates, it is difficult to compete with public bonds through other instruments.

Santana raised alternatives to diversify the investments of pension funds, without compromising the profitability or security of these resources.

One of them would be that the emission of government bonds could be linked to infrastructure projects and that the profitability and risk of those investments of the AFP depend on those projects. “That would force AFPs to truly administer, because their current work is too easy: they only have to buy titles whose profitability guarantees it the Treasury.”

Another option raised by Santana would be to invest in exterior stock exchanges or Treasury bonds of the US or other developed country, but that would be a contradiction, when the country itself has to place debt abroad and “a penalty having the country so much need for capital.”