He country risk It is an indicator that analyzes the probability that a territory cannot comply with its international financial obligations, either for political, economic or social reasons. This is measured through the emerging market bond index (EMBI), which was developed by JP Morgan.

(Read more: Colombia runs the risk of staying again with a deficit above 6% in 2025)

The EMBI calculates the performance of the sovereign bonds issued by nations of emerging markets compared to the US Treasury bonds. In other words, when a country has a high ram, It means that your bonds pay a much greater interest rate than that of these American roles, which indicates that investors perceive more possibilities of default.

The higher the number of basic points, the greater the country risk, which in turn translates into more difficulty in accessing external financial aid.

Now, in 2024 sovereign bonds showed an improvement in Latin America. This allowed to reduce the EMBI of some countries in the region as Argentina, Ecuador and El Salvador, thus contributing to an increase in investor trust.

Bonds

Istock

(Read more: what the basic basket costs in Latin America, country by country)

What is the panorama for 2025?

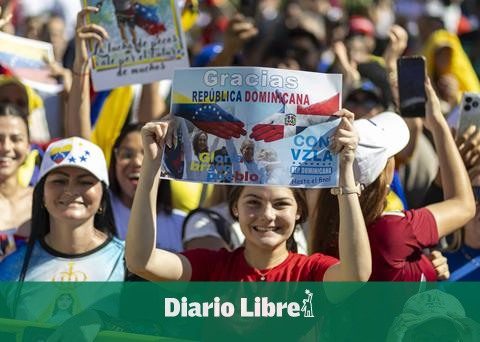

Based on JP Morgan’s data, the nation remains with the highest country risk in Latin America is Venezuela. The EMBI of this neighboring country is 24,970 basic pointsan extraordinarily high figure that reflects a critical perception by financial markets in relation to their economic stability.

Then Bolivia appears on that list, with an index of 2,092 points. Although this value is significantly lower than that of Venezuela, it remains elevated compared to other territories of the region.

(Read more: IPC Colombia 2025: the services and products that would rise or lower price)

Venezuela

EFE

The following positions are occupied by Ecuador, with a level of 1,069 points; Argentina, with 641 points; Honduras, with 428 points; El Salvador, with 437, and Paraguay and Mexico, with 317.

In the case of Colombia, the country risk is currently at 315 basic points. This indicates that investors perceive the national territory with a moderate risk and position it in an intermediate position in relation to their sister countries.

(More news: X -ray of influencers in Colombia: How much do consumers believe?)

Portfolio