The Russian invasion of Ukraine has blown up commodity prices

raw materials, a scenario that in Latin America could benefit countries that export grains and hydrocarbons, but will harm importers. Both will suffer higher inflationary pressures that will erode its prospects for economic growth this year.

(Exports close January with a rise of 44.8%).

Due to the strategic role of Russia and Ukraine as major suppliers of energy and food, the war has shaken global markets, fearful that supply chains severely impacted by war and the economic sanctions imposed on Russia.

Latin America is not significantly exposed to Russia directly in terms of investment and trade. According to data from the consulting firm Capital Economics, trade with Russia and Ukraine represents less than 1.5% of the total exports and imports of goods of the main Latin American economies.

However, and despite the high uncertainty about the scope and duration of the armed conflict, experts warn that the region will suffer a strong indirect impact through the prices of raw materials.

(80% of Russian bank assets already have US sanctions.)

According to Michael Heydt, senior vice president of Global Sovereign Ratings at rating agency DBRS Morningstar, Latin America includes a diverse set of countries in economic terms, and “while higher prices could benefit some net commodity exporters, other parts of the region depend heavily on imports, such as Central America and the Caribbean”

“The higher costs of energy and food could considerably weaken the prospects of these countries by negatively affecting purchasing power and increasing inflation,” Heydt told Efe.

OIL AND GAS, BETWEEN COSTS AND BENEFITS

Since the Russian invasion of Ukraine,s international hydrocarbon prices have skyrocketed on fears of a supply disruption from Russia, one of the world’s largest oil and gas producers.

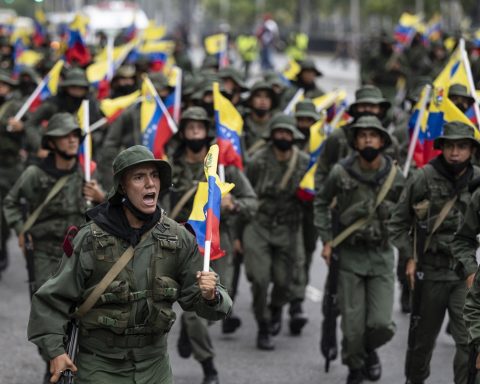

Shipments to Latin America of crude oil and liquefied natural gas (LNG) from Russia are very limited. However, the region -with countries that produce and export hydrocarbons and others that are net importers- will feel the effects of shocked international energy markets.

(Coffee production in Colombia fell 16% in February 2022).

According to Luciano Codeseira, director of the consulting firm Gas Energy Latin America and executive partner of the firm Ceibo Growth Strategies, Brazil and Guyana are emerging as the exporting countries that will most benefit from the rise in oil prices, while Venezuela and Ecuador “will have an improvement in prices in an adverse context of production”.

Argentina, for its part, continues to develop the gigantic Vaca Muerta unconventional hydrocarbon formation, but the negative balance in its energy balance will increase due to the growing need to import more volume of LNG in the coming austral winter at prices much higher than those of 2021.

“The countries that fully import oil, liquid fuels and gas will of course be the most affected, but they will be able to balance these costs with better prices of commodities that they themselves export. The question for each country will be who bears the new costs and benefits of the leap prices in general,” Codeseira told Efe.

AGRO: BETWEEN THE “BOOM” OF PRICES AND THE LACK OF FERTILIZERS

The war conflict also has strong repercussions on agricultural markets, where several Latin American countries have a strong weight at the global level and where prices of grains and derivatives have skyrocketed. Russia and Ukraine account for nearly a quarter of world wheat exports, a cereal of which Argentina is also a major world producer.

Ukraine is also a key player in the corn market, dominated by the United States, Brazil and Argentina. It is also, along with Russia, a strong exporter of sunflower oil, in competition with this and other vegetable oils produced by Argentina and Brazil, countries that will benefit from better prices although they will have a poorer agricultural harvest due to the drought.

On the contrary, Latin American countries that need to import grains fear inflationary effects. “If there is less wheat for everyone, the price will rise and we will have an impact on the basic basket,” the executive director of the Research Institute told Efe. and Foreign Trade Development of the Lima Chamber of Commerce, Carlos Posada.

The war in distant Ukraine could also create a major threat to the agricultural sector in Latin America: the shortage of fertilizers. According to a report from the Rosario Stock Exchange (Argentina), Russia is the world’s leading supplier of fertilizers of all kinds, accounting for about 13% of global trade.

Since the beginning of the conflict, prices have skyrocketed, generating a headache in Argentina, Brazil, Colombia and Paraguaywhich could face problems to supply themselves and, eventually, suffer cuts in their agricultural production. “Although it is too early to say so, an agricultural campaign could be in danger. It could be a fairly important threat,” Leonardo Piazza, director of the consulting firm, told Efe. LP Consulting.

In Colombia they also fear that the exclusion of Russia from the Swift interbank payment system harm its beef exports to that country.”We will not be able to pay or be paid for goods marketed with them, which constitutes a severe blow to the sector’s GDP,” warned the president of the National Council of Secretaries of Agriculture of Colombia, Rodolfo Correa.

MORE INFLATION, LESS GROWTH

The benefits that certain Latin American countries could obtain from a global scenario of record prices for raw materials, however, have their harmful “side B”: higher domestic inflation at the hands of rising food and energy prices, impacting these last in the costs of services and industries.

The region had already been suffering from inflationary pressures derived from the global health crisis. Now you will face additional challenges. “Chile is a net importer of oil and the price increase affects the entire consumption basket due to the effects on transportation,” Francisco Castañeda, economist and director of the Universidad Mayor’s Business School, told Efe.

In Mexico, its president, Andrés Manuel López Obrador, has assured that, despite the war, it is “guaranteed” that there will be no increases in the price of gasoline, but economists are beginning to revise inflation forecasts upwards. It is ruled out that it reaches 8%. And if the price of oil reaches historical highs, it could reach levels close to 10%,” Gabriela Siller, director of economic analysis at Banco Base de México, told Efe.

Higher inflation will have a negative impact on the growth rate of Latin America, which, before the outbreak of the war in Ukraine, had been projected for this year by the Economic Commission for Latin America and the Caribbean (ECLAC) at 2.1%, from 6.2% in 2021. At higher prices, lower real household income.

The lower consumption, the lower economic growth. In addition, an acceleration of inflation will force the region’s central banks to tighten policies, ?reducing? economic expansion.

In addition, according to Heydt, an increase in global tensions “could potentially lead to capital outflows from Latin America, putting downward pressure on local currencies and increasing inflationary pressures.” “It could also weaken global demand for goods and services in the region. Such dynamics would act as a headwind for a region that already faces a prospect of weak growth and high inflation in 2022,” the analyst warned.

EFE