The ‘drop by drop’ is still present in the country and winning more and more victims. Currently in Peru there are 18 applications that grant informal loans, according to the coordinator for the supervision of informal activities of the Superintendence of Banking, Insurance and AFP (SBS), Daniel Reátegui.

Among those ‘apps’ are Credit Sol, accreditaya, silk credit, picchu cash, Hisol, ray loan, smart loan, lenders, chambasol, easycrédpe, and crash.

The list also includes Ekecrediyo, loan hand, felling, enjoycérédito, Toppress, Fielsol and Mastersol, according to the information of the SBS.

When users download these applications, provide personal information and access to their telephone directory. In addition, they collect and monitor the information of the mobile team, such as photographs and videos.

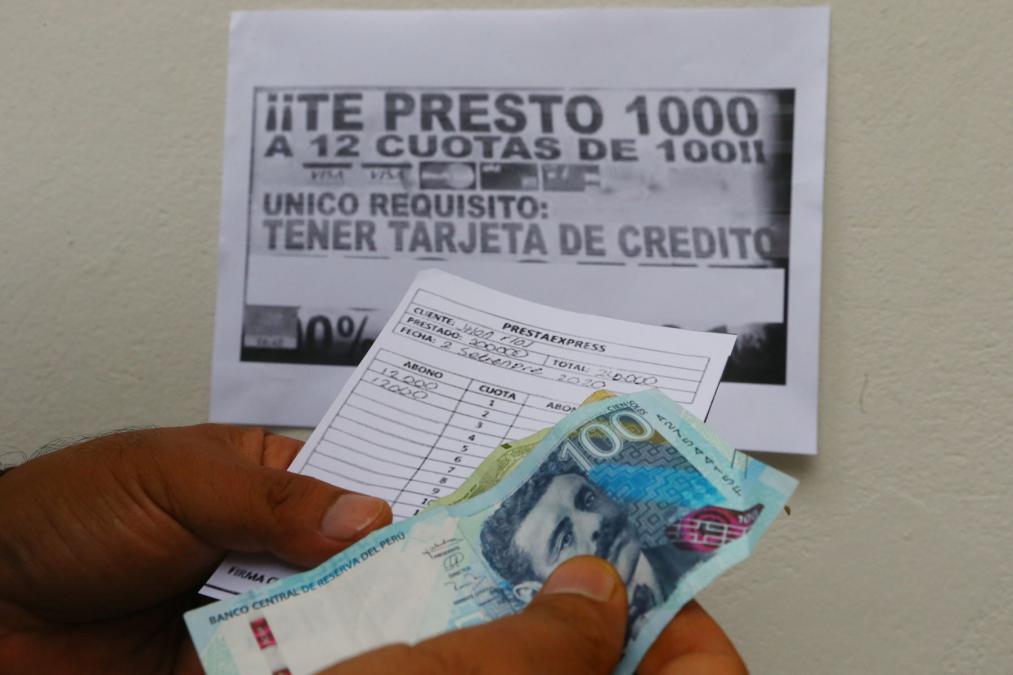

Likewise, another risk that is presented is referred to the interest rate. The head of the Deputy Affairs Department of the SBS, Carlos Cueva, explained that, although loans are offered from S/5,000, in the long run it is only disbursed approximately s/100, and with high interest rates.

“They offer you rates of 60% to 80%, but then they put some requirement that has also to be paid, and therefore through this modality it ends charging amounts that are unpayable,” he said in dialogue with the press.

Money collection

But applications are not the only informal schemes that are still latent. The SBS representatives revealed that they have detected four new entities that capture money from the public without having the authorization of the Superintendency.

Among these companies are Infinity Corporation capital, Finniu SAC – ‘Finniu App’ and Algamarca SAC Corporation – Algamarca Corporation. These three capture money through their websites or social networks.

Meanwhile, the presentation of Multiple Quechuas, Ayamaras and Ashánikas Limitada was also detected, which does not work through the Internet, but it does have its office in Juliaca.

Complaints

According to SBS information, last year they received 4,014 communications referring to consultations and complaints about informal activities in supervised systems. January, March and April were the months with the most reports of these cases.

The Superintendency also revealed that they received 1,054 complaints about illegal schemes in 2024, of which 774 were due to informal applications, 98 by illegal money collection schemes, 49 for fraudulent loans and 133 for other modalities.

In that sense, the Superintendency recalled that the email [email protected], the National Free Line 0800-10840, the number of Whartsapp 976 263 333 and the page www.sbs.gob.pe/informality.

Take advantage of the new experience, receive by WhatsApp our enriched digital newspaper. Peru21 Epaper.

Now available in Yape! Find us in Yape Promos.

Recommended video