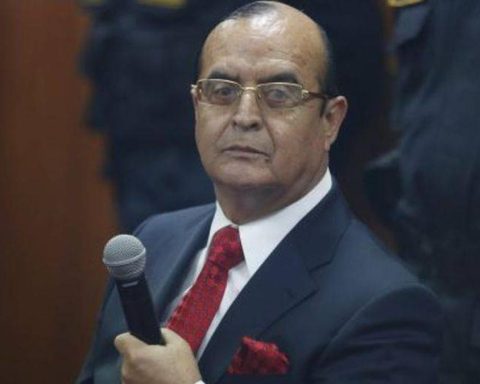

Since its arrival in Peru in 2011, the Peoplera Group has consolidated its presence through Compartamos Financiera. Ralph Guerra, its general manager, details what is coming for the entity.

How many years have passed since the Peoplera group in Mexico invested in financial creation?

We speak almost 14 years of the presence of people in Peru through Compartamos. Peoplera’s impressions about our country have been very positive for all the progress achieved in the financial inclusion front, which is the most relevant objective of the group. This thanks to the fact that we have had a very clear strategy both with the offer of group credit and individual and savings products, which have contributed relevantly in that dream that is realizing.

In all that time, how much could they have grown as an entity?

When we came to Peru, created served just over 85,000 clients, already December 2024 we served 1.2 million. Evolution has been meteoric. In terms of loan portfolio, we handled more or less S/400 million and now we are reaching almost S/4,300 million. We had a presence in just two departments; Now we are in 22. We had almost 1,000 collaborators and now practically 6,800. With those numbers, I would say that the investment for the group has been very successful. There is an important point that I must also highlight.

Which?

The group since it arrived has capitalized 100% of the profits because it seeks to consolidate the positioning and development of Compartamos in Peru. Even during the COVID-19, we were one of the two companies of the microfinance system that strengthened its capital to address the challenges of this crisis, with a contribution of just over S/200 million.

After 14 years, is the context conducive to investing in microfinance?

I’m going to tell an anecdote that helps me answer your question. When Pueblora evaluated the purchase of Financiera Crear, our country was in the term of the political campaign prior to the election of Ollanta Humala. And, without knowing what this choice meant, the bet occurred. This explains that people are here to stay. Therefore, political situation are part of the challenges to be attended, but they are not an element that weakens the intention of continuing to invest.

What are the synergies that could be achieved with Mexico?

Group credit, for example, is a methodology that people brought from Mexico, where they have a lot of experience. And from Peru we bring to Mexico the experience of individual credit. This is the model in which it has been working, in addition, with the commitment to Peruvian talent.

What other bets have had?

We have worked hard for customers to save and have a savings culture that allows them to meet their additional needs or achieve their dreams, such as the construction of their home. There we are working very hard, because this is one of the biggest objectives in which we are dedicated and that talks a lot about the results we have had so far.

How do you see 2025?

We see 2025 with very positive expectations. One of the most relevant strategies in which we have been working, especially in recent years, has been in our transformation, in which digitalization has been extremely relevant. If you go to a sharing office, you will find a different reality from that of a year and a half ago. In addition, customers already receive their credits through their electronic wallet, which in the case of Compartamos is BIM. I would say that 70% of our clients already make their transactions digitally.

Is Bim already interoperable?

It is interoperable with any wallet and at this time we are finishing a project with the electronic compensation chamber so that the client of any bank can transfer money to Bim and vice versa.

What is coming?

In terms of the number of clients, the idea is that in 2025 we can grow 30% compared to 2024. Of these, 77% are credits and 23% savings. And in terms of loan volumes, we hope to grow more than 10%. We are focused on generating inclusion.

DATA

In June 2011the Group Compramos, today Group Pueblo, acquired 82.7% financial creation and in 2015 it was 100%.

Financial create It is born from the transformation of the EDPYME to create Arequipa that operated since 1997 and has as roots the NGO Habitat Arequipa.

Ralph Guerra He works at the institution since its inception as NGO, 32 years ago.

Take advantage of the new experience, receive by WhatsApp our enriched digital newspaper. Peru21 Epaper.

Now available in Yape! Find us in Yape Promos.

Recommended video