Other initiatives the president-elect has launched, such as reducing bureaucracy and taxes, could also fuel inflation by boosting demand, he added.

“The bottom line is that when we look at the risk to the United States, we see an upside risk to inflation,” he said.

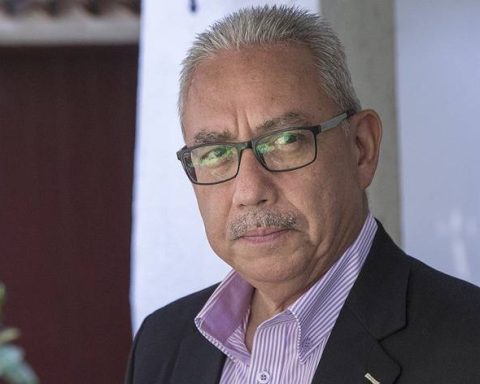

Gourinchas spoke to AFP at the IMF headquarters in Washington, a day before the publication this Friday of its key World Economic Outlook (WEO) report.

In the WEO update, which did not take into account Trump’s proposals due to political “uncertainty,” the IMF raised its forecast for global growth and sharply raised its outlook for the U.S. economy.

Many economists view Trump’s plans on tariffs and immigration as inflationary, but the Republican and his advisers have counterattacked, arguing that the overall package of measures he plans to enact should help keep prices in check.

Traders have reduced the number of rate cuts they expect the US Federal Reserve (Fed) to make in 2025, assigning a roughly 80% chance that it will make no more than two quarter-point cuts this year. according to data from CME Group.

Gourinchas said the IMF expects the Fed to cut rates by half a percentage point in both 2025 and 2026, a forecast in line with the average projection of Fed officials surveyed in December.