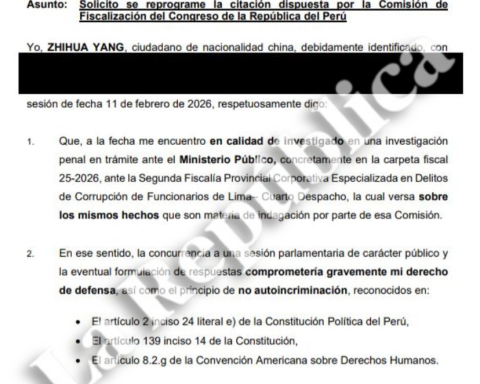

According to experts, this is how the dollar will behave during 2025.

Dollar in 2025.

As 2024 draws closer, economic expectations for next year continue to take shape. This is why many people wait for these analyzes to determine how the economy will function by 2025.

Analysts, through Financial Opinion Surveyproject a series of key indicators that will define the country’s economic outlook in 2025. Among the highlighted forecasts, it is expected that the intervention rate of the Bank of the Republicclose 2024 at 9.25%with a slight decrease in the coming months. Furthermore, economic growth is estimated at 2.6% by 2025, after 1.8% projected for this year.

As for the inflationexperts predict a closing of 2024 at 5.15%, with a deceleration towards 3.9% by December 2025, reaching the target range of Bank of the Republic.

Also read: Colombia’s economic growth: Challenges and new opportunities

How the dollar will behave in 2025

He The behavior of the dollar in 2025 will be one of the key factors to understand the economic panorama of Colombia. According to analysts, the rate of exchange rate closes 2024 between $4,320 and $4,350, a figure that reflects slight stability, but still far from the lowest levels observed in previous years. This exchange rate in December is considered a medium response to market expectations.

For the following year, experts project that the dollar value It will remain in a similar range, but with a slight tendency towards the appreciation of the Colombian peso.

It is estimated that by the end of 2025, the exchange rate will be $4,368, suggesting the weight could gain something of value against the dollar, although gradually. This behavior will depend on several factors, including internal economic policies and the international situation.

You may be interested in: Dollar on the rise in 2025: experts anticipate a possible peak close to $5,000

The behavior of dollar will be crucial not only for the country’s imports and exportsbut also for economic sectors that depend on foreign investment. The stability of the exchange rate could offer some predictability for businesses that handle international transactions and for consumers facing dollar prices, especially on products like oil.