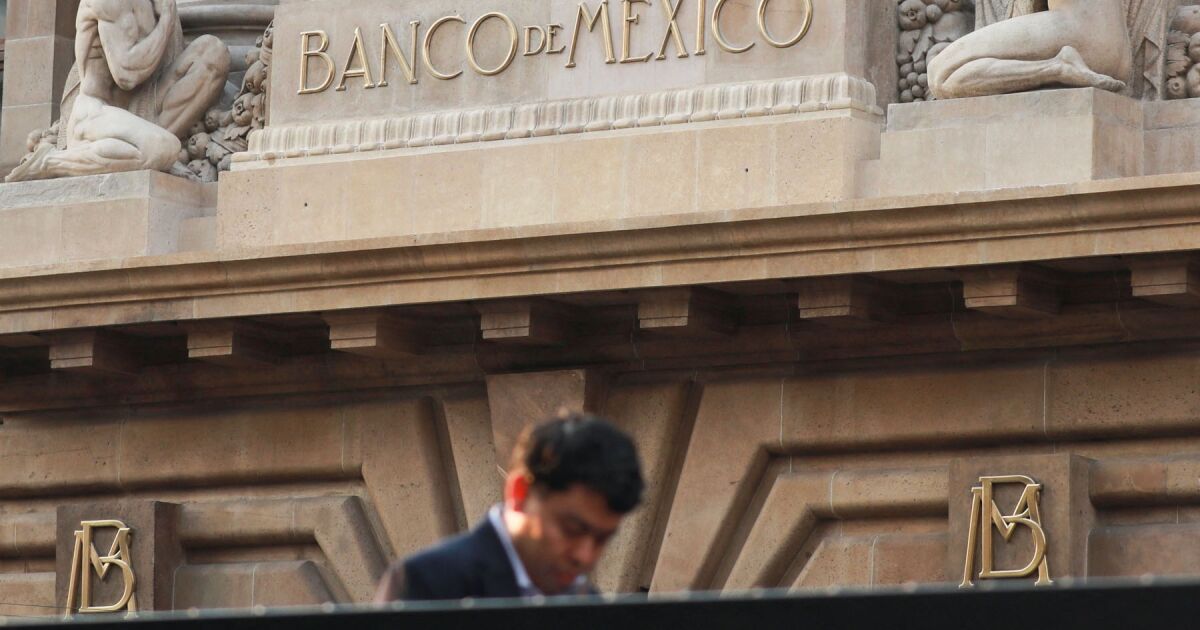

Banxico expects that the inflationary environment will allow it to continue reducing the reference rate in the following months.

In November, inflation stood at 4.55%; However, this figure is still far from the central bank’s goal of 3%.

Banco de México expects that both general and underlying inflation will show a downward trend going forward.

“The possibility of tariffs being implemented on United States imports from Mexico has added uncertainty to the (inflation) forecasts,” the central bank highlighted.

Banxico cut in the face of a ‘hawkish’ Fed

This week, the Federal Reserve (Fed) also voted to lower the interest rate by 25 points this week and placed it between 4.25% and 4.50%.

The Fed revised its macroeconomic forecasts and adjusted the future guidance of monetary policy. The US central bank is only expected to make two quarter-percentage point rate cuts sometime in 2025.

In his press conference Jerome Powell, president of the Fed, said that with this latest cut, the monetary stance is less restrictive, so now the Committee has to be more cautious for the next adjustments.

“If the Federal Reserve cuts little, it puts a floor on the other central banks in conducting monetary policy. In this case, a greater widening of the rate differential between the Federal Reserve and the European Central Bank means a greater depreciation of the Euro in the coming months,” Intercam highlighted.