The Popular Savings and Loan Association (APAP) announced the integration of digital solutions designed for people with visual disabilities, reaffirming its commitment to the autonomous and safe management of their finances through technological innovation and financial inclusion.

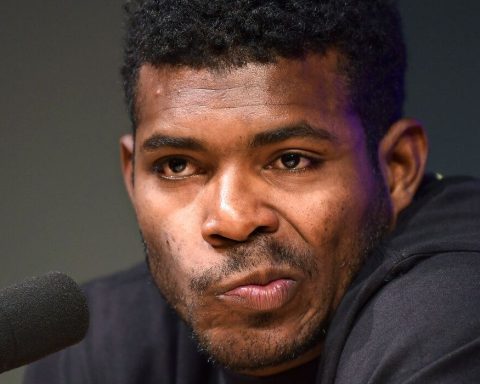

Serguey Forcade, explained that among the facilities of the application APAP Mobile -developed with an inclusive approach-, there is compatibility with assistive technologies such as VoiceOver on iOS devices and TalkBack on Android, making it easier to use for people with visual impairments.

“These enablers allow our clients to perform various financial operations autonomously, such as checking the balances of your products, opening digital savings accounts or accessing debit cards virtually, making transfers between accounts APAP or to other banks, pay services and bills, among others,” the executive added.

In addition, the financial institution It has a process of incorporation into the financial system, known as digital onboarding, this process allows new people to become clients without having to visit a branch.

Features

- Features include: guided textsdesigned to facilitate a fast, intuitive and accessible experience, especially for users with a disability condition.

APAP has led digitalization in the sector, offering solutions such as opening savings accounts and mortgage products in digital format, unique in the country.

“These initiatives are supported by a technology stack and artificial intelligence tools that optimize security, improve the customer experience and guarantee accessibility for all”, it is explained through the press release of APAP.

Likewise, it also promotes the democratization of financial services through inclusive processes that allow young people from the age of 16 to integrate into the financial system and Dominicans abroad to access services remotely.

With these actions, the entity contributes to the development of a more inclusive, accessible and future oriented.