From the 58th Annual Assembly of the Latin American Federation of Banks (FELABAN), Visa announced the results of his second Global annual working capital index of growing companieswhich revealed important advances in working capital efficiency, especially for growing companies of Latin America and the Caribbean.

The results indicate that more than seven in 10 financial directors and treasurers (75%) in the region reported better buyer-supplier dynamics when using external working capital and 69% said they were better able to meet customer demand and take advantage of opportunities thanks to access to financing.

(We recommend: Financial risk of public IPS: more than $12.4 billion in portfolio and growing deficit).

The study also reveals that, although Latin America shows more concern than other growing companies about a possible recession and therefore disruptions in the supply chain, CFOs in the region share an optimistic view about the future and the role of working capital as a strategic driver for business growth and performance. 85% of companies interviewed indicated they would likely use at least one working capital solution in the next 12 months.

From a global perspective, more than eight in 10 CFOs and treasurers leveraged working capital solutions, recording a 13% year-on-year increase while top-performing companies across all regions also demonstrated notable financial efficiency. This allowed them to save an average of US$11 million in interest and fees, registering a 300% year-on-year increase in efficiency..

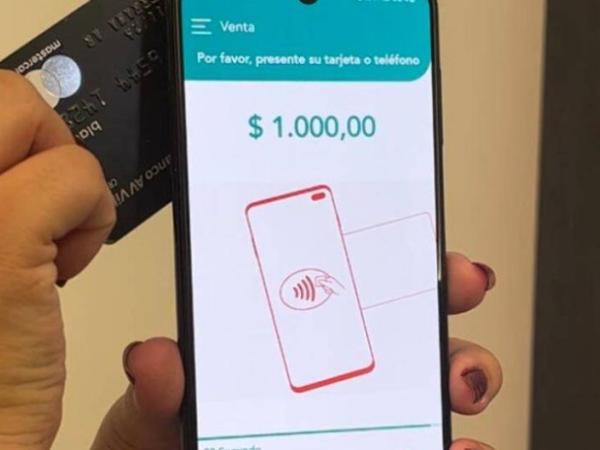

Electronic payments

The Index surveyed nearly 1,300 CFOs and treasurers across 8 industry segments and 23 countries. The study included 214 companies from Latin America and the Caribbean, which represented an increase of 73% compared to the 124 companies surveyed in 2023. All companies represent ‘growth companies’, which are organizations that generate between $50 million and $1 billion in annual income.

(Besides: If they make this call to you in Colombia, hang up, it’s a scam: the police warn).

“This year’s results from our Working Capital Index demonstrate that access to flexible and innovative working capital solutions is becoming critical to driving growth for mid-market companies and helping them improve their operational efficiencies.“, said José Luis Gonzales, Visa Business Solutions Leader for Visa Latin America and the Caribbean.

“This segment is a critical driver for our local economies, and as these companies continue to navigate macroeconomic uncertainties, at Visa we are committed to being an enabler for these companies, providing the best working capital strategies to effectively address the complex needs of these companies. corporate clients and help them thrive in this dynamic digital ecosystem”he added.

Electronic payments

Latin America and the Caribbean is the region where personalized/flexible products from banks matter the most; Growing companies in the region seek customized, industry-specific working capital products (25%), indicating a significant regional focus on customized solutions.

(You may be interested in: ‘We must reactivate sectors of the economy that are barely emerging from frustration’).

They also expect bankers to offer technological and primarily digital innovations (16%) with faster approval processes, aligned with their strategic growth agenda, while seeking consulting services (15%).

Use of virtual cards

The virtual cards show a steady rebound as an efficient and effective working capital solution. From a global perspective, virtual cards saw an increase in usage of 32% year-on-year while 18% of companies surveyed in Latin America and the Caribbean used corporate/virtual cards, recording growth of 13% year-on-year.

Growing companies that used virtual card solutions had a increased likelihood of days pay outstanding (DPO) reductionstrategic utilization of working capital, better cash flow predictability, more integration of suppliers into payment systems and early payment to suppliers.

The study also shows that 80% of top-performing companies recognize the versatility of virtual cards to act as both an accounts payable solution and a financing solution. The use of virtual cards is projected to double next year, compared to bank lines of credit, with a projected increase of 67%.

PORTFOLIO