Brazil had the fourth highest economic growth in the third quarter of 2024 among the G20 countries that have already released the results for the period. The G20 brings together the 19 largest economies in the world plus the European and African unions. According to the Quarterly National Accounts System, released on Tuesday (3) by the Brazilian Institute of Geography and Statistics (IBGE), the expansion compared to the second quarter was 0.9%.

Despite the prominence in ranking of growth, experts consulted by the Brazil Agency advocate increasing productivity and the level of investment so that the positive performance of the Gross Domestic Product (GDP, the set of all goods and services produced in the country) is not just a “flight of the chicken”, that is, not lasting.

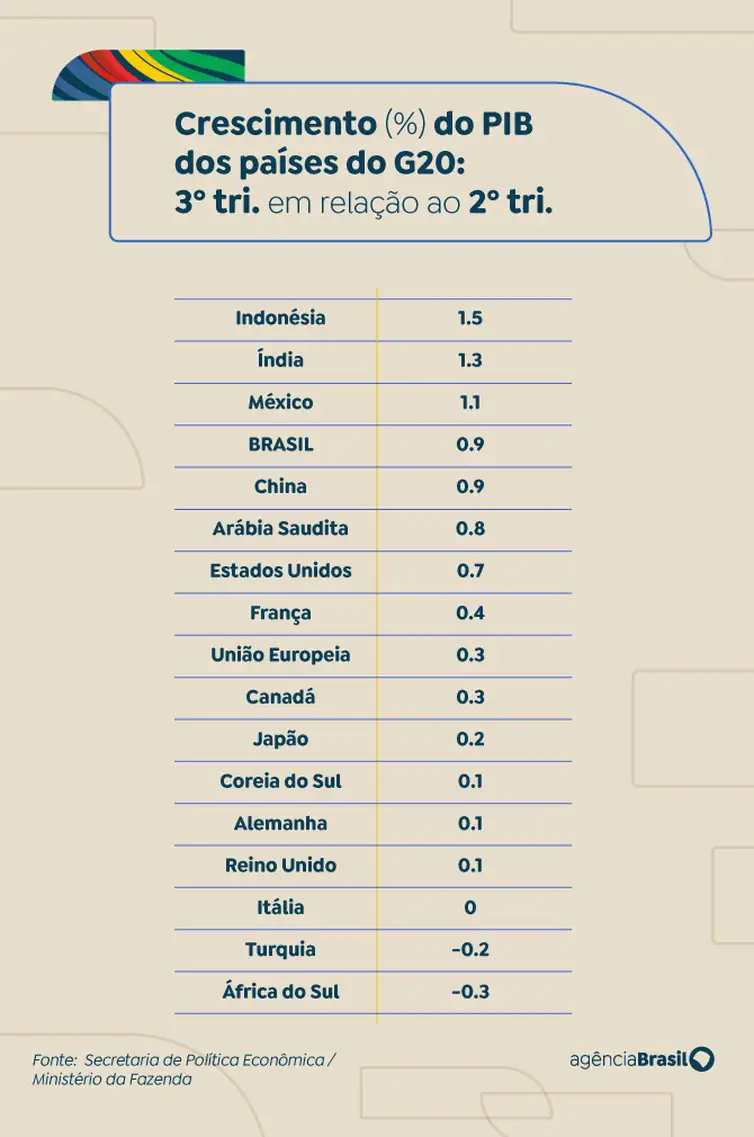

One lifting carried out by the Secretariat of Economic Policy (SPE) of the Ministry of Finance shows that the quarterly performance of the Brazilian economy is second only to that of Indonesia (+1.5%), India (+1.3%) and Mexico (1.1 %), matching the expansion of China (+0.9%). THE ranking shows that the country surpasses nations such as the United States (+0.7%), France (+0.4%), Germany (+01%) and the United Kingdom (+0.1).

Comparing the third quarter of 2024 with the same period in 2023, Brazil also presents the fourth largest expansion, with a jump of 4%, behind only India (5.4%), Indonesia (5%) and China (4 .6%). The United States, the largest economy in the world, is in seventh place, with a GDP increase of 2.7%.

“This growth is really strong not only in the third quarter, but throughout the year”, highlights economist Juliana Trece, from the Brazilian Institute of Economics (Ibre) at Fundação Getulio Vargas (FGV).

Revised expectation

With the Brazilian result in the third quarter of 2024 considered surprising, the SPE states that the Ministry of Finance’s projection for this year’s GDP growth, currently at 3.3%, “should be revised upwards”.

Already the Focus newsletterprepared by the Central Bank based on projections from financial institutions, estimates that GDP will grow 3.22% this year. Four weeks ago, the projection was 3.10%.

According to assistant professor of economics Caio Ferrari, from the State University of Rio de Janeiro (Uerj), the expansion of GDP will not be enough for the country to rise in the ranking global economies. He mentions that the countries that precede Brazil are Canada (ninth) and Italy (eighth).

“Canada is going through a good time economically, with low inflation and increased immigration. Italy is going through a slightly more complicated time, with challenges such as high debt, but the difference in the size of production is around US$200 billion [R$ 1,2 trilhão]. So, at least in the short term, Brazil’s growth will not allow it to reach these economies”, he assesses.

“Another point is that the growth accumulated in the last year, which is around 4%, is close to the average of developing economies like Brazil, that is, the country is expanding, more or less, at the rate that similar countries grow. ”, he adds.

Need for investments

Economist Juliana Trece considers that Brazil has a major challenge to maintain its growth trajectory in the ranking global. “We always end up facing a barrier in international comparison related to our investment rate.”

According to IBGE, the Brazilian investment rate in the third quarter was 17.6%, which represents growth compared to that observed in the same period of the previous year (16.4%).

“It has gone up, but, if compared to other countries, it is still a very low rate. In Latin America, for example, it is around 21%”, explains the coordinator of FGV’s GDP Monitor, a study that seeks to provide data on the behavior of the Brazilian economy.

She adds that Brazil faces the prospect of an increase in the basic interest rate (Selic) in 2025, “and this exactly affects investment”.

Selic is an instrument of the Central Bank to mainly control inflation. A high rate is synonymous with a brake on economic activity, which has the potential to contain price increases, but, on the other hand, discourages investment and the creation of jobs and income.

Currently the rate is 11.25% per year. Focus’s expectation is that basic interest rates will end in 2025 at 12.63% per year.

When pointing out drivers of the Brazilian economy, professor Caio Ferrari cites export-oriented agribusiness, “the devaluation of the exchange rate helps to make Brazilian exports more competitive”, and the demand generated by growing government spending.

But he emphasizes that, for the growth trajectory to prove sustainable, the economy’s production capacity must expand, instead of depending on increased exports and demand driven by government spending.

“An expansion on the side of fixed capital formation [investimentos] it would be a more reliable indication that growth would be more perennial or long-term”, he states.

“The main challenge of the Brazilian economy is gaining productivity and, in this regard, the data actually shows a worsening in recent years since the political crisis, which will soon be ten years old”, adds Caio Ferrari, citing the crisis which ended in impeachment of President Dilma Rousseff, in 2016.

Quality of life

Juliana Trece, from FGV, assesses that, for GDP growth to be reflected in an improvement in the population’s quality of life, the country also needs to move towards reducing inequalities. She cites the government’s income transfer programs, such as Bolsa Família. “They are fundamental and very important.” But he points out that there are still other ways to reduce disparities.

“One of the best ways to change the structure of inequality is to change education. This is not only good for quality of life, it has an impact on the economy, on productivity”, he highlights.

“It’s something very important to think about sustainability in growth and improving quality of life”, he adds.

The economist adds that one of the problems is the fact that investment in education does not have immediate effects.

“You have to start investing now and in ten, 15 years this population with more quality education will start to enter the job market, and then you will be able to see improvements”, explains Juliana Trece.

She adds that, even in the “delicate environment” of government spending levels, “investing in education is not a cost.” “It’s really an investment to have a more solid country”, he considers.

Real economy

The release of positive GDP contrasted with the negative result of the main theoretical index of the financial market, Ibovespa, from B3 (formerly the São Paulo Stock Exchange), which can be understood as an average of the behavior of the shares of the main companies listed on B3 . While the Brazilian economy grew 3.3% from January to September, the Ibovespa closed November with a drop of 6.35% for the year.

Juliana Trece explains that this has to do with the fact that the stock market is based more on expectations, which involve variables other than GDP.

She mentions that in the real economy Brazil has an unemployment rate at historic lows – 6.2% in the quarter ended in October – but inflationary pressure and a likely rise in interest rates, which end up being bad for economic activity.

She also recalls that the so-called “market” – a trading environment formed by large investors and speculators, who operate in the purchase and sale of assets (shares, currencies, public bonds, etc.) – found “noise” in the cost cutting package presented by the government last week.

“The feeling is that [os cortes] could be bigger, there was a lot of noise with the declaration about the income tax exemption for [quem recebe] up to R$5 thousand. So it ends up generating this uncertainty”, he explains.

The government has argued that the loss of revenue caused by the exemption will be compensated by higher taxes on people who receive more than R$50,000 per month.

Professor Caio Ferrari sees that there is a bit of “temperity” in the market with the result, which is largely driven by government spending.

“With the fiscal challenge that the government faces, the spending cuts and tax increases that will have to come in the future reduce some of the optimism for a sustainable growth trajectory. In short, the fear is that today’s positive result is just a ‘flight of the chicken'”, he assesses.

In Congress

The spending cut package that limits the real increase in the minimum wage and creates restrictions on access to Bolsa Família and the Continuous Payment Benefit (BPC, which guarantees a minimum wage for low-income elderly people and people with disabilities) was sent by the government to the Chamber of Deputies. The federal Executive’s intention is to vote on the text in 2024.