The international prices of oil and refined fuels have shown a notable escalation practically since the covid-19 pandemic broke out. Anyway, the government has chosen to partially transfer this correction to Uruguayan consumers. Thus, it was shown in data that disclosed the Ancap oil company on its Twitter account this Friday. During 2021, the company sold gasoline and diesel some US$ 105 million below the value shown by Ursea’s PPI.

In the case of Super 95 naphtha, the gap given by the difference between the ex-plant price received by Ancap and that set by Ursea’s PPI was US$46 million lower. In other words, if Ancap had sold that gasoline at 100% of what the PPI showed, its income would have increased by those US$46 million, something that would have significantly improved its operating result in 2021. In December, for example, Ancap received income of US$ 58 million from the sale of Super naphtha, while the theoretical value of the PPI indicated that it should be US$ 64.3 million. In the months of April and May – when the government chose to freeze rates due to the pandemic – this gap was also significant to the detriment of Ancap, as can be seen in the graph.

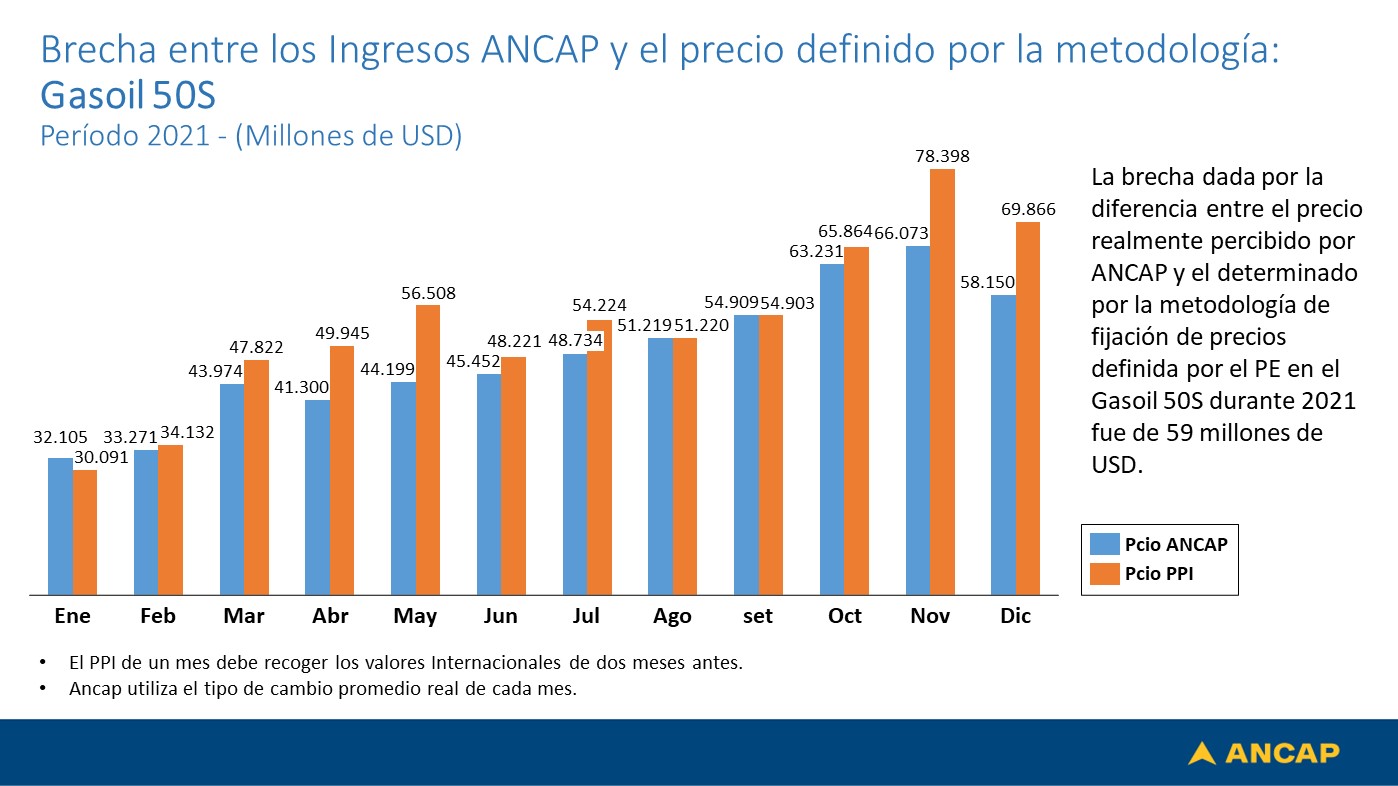

In the case of diesel 50 S (common), the gap generated between prices during 2021 was US$ 59 million to the detriment of Ancap. In December, for example, the state oil company received revenues of US$58.1 million when the PPI showed that figure should be around US$69.8 million.

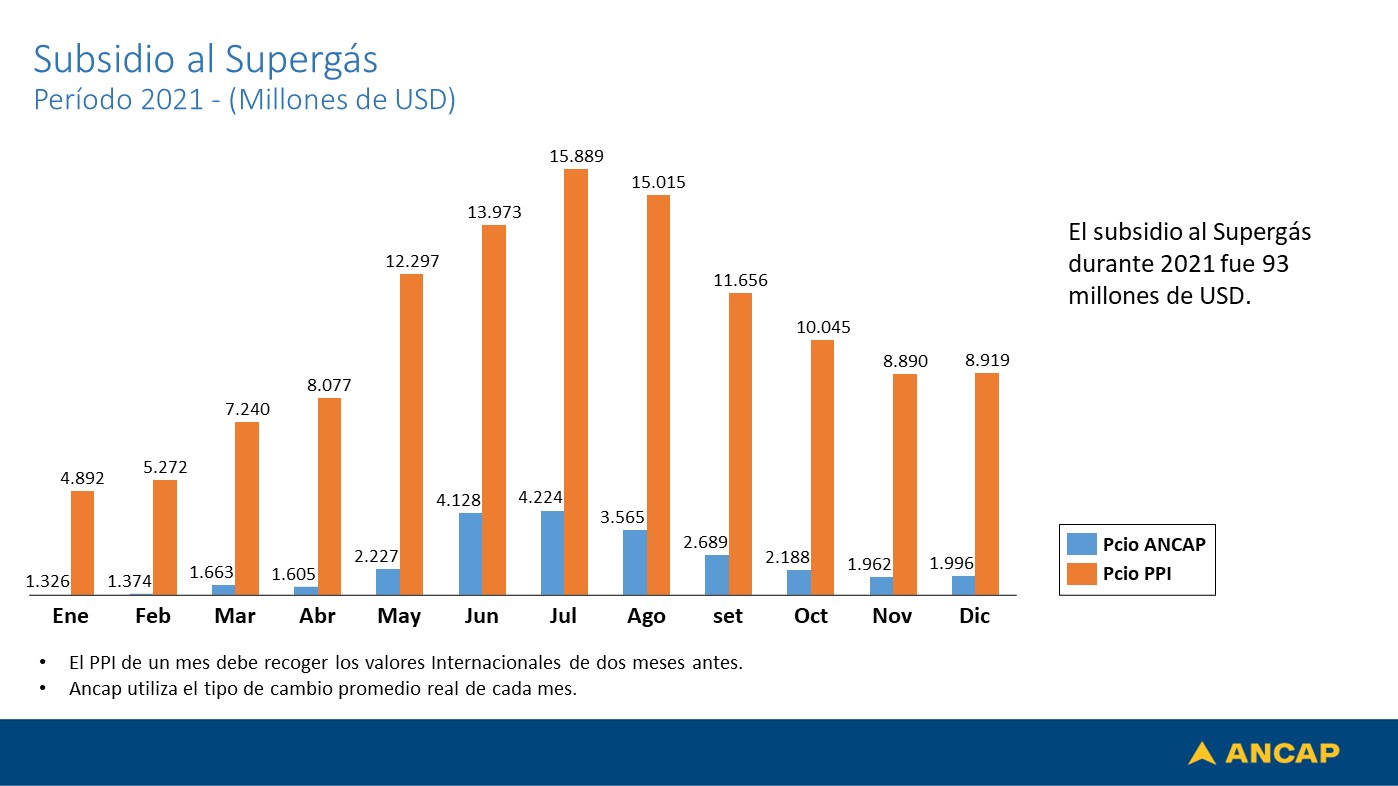

The flip side was the case of supergas, where Ancap sells this fuel with a strong subsidy at a price significantly lower than its cost.. In 2021, this subsidy to all consumers of this type of energy rose to US$ 93 million. To get an idea, last December, Ancap received income from the sale of this fuel for US$1.9 million when it should have been for US$8.9 million if the PPI criterion is followed.

Why Ancap, if it sold gasoline and diesel oil below the PPI, did not lose money and even won in 2021?

This week the president of Ancap, Alejandro Stipanicic, explained to The Observer because the eThe company was able to cope without major shocks with the situation of selling diesel and gasoline below the theoretical price of the PPI throughout 2021. The hierarch indicated that what was behind that was a “considerable increase” in the refining margin of La Teja, in line with what happened with refineries in other countries, as well as an increase in marketing volumes, in particular, due to the sale of diesel to UTE for power generation electrical. Typically, the refining margin is $3 to $5 a barrel, but last year it rose to $7 a barrel.

La Teja usually has a reduced margin in international comparison given its small size. The refining margin is determined by the weighted average of the refined products less the cost of crude. In 2021, there were months last year where that margin reached US$10 per barrel.

“That was what generated back to sell fuels below the import parity price,” explained Stipanicic. That allowed the company to close last year with cash for about US$200 million, which is what has allowed the government to continue without transferring 100% of what the PPI shows in the values of sale to the public.