As a response to the delays in the process of guaranteeing the credits that the Nation needs to issue to solve its cash problems, which have generated so much annoyance within the Government, the Executive is currently working in a standard to make this requirement more agile before the Interparliamentary Commission on Public Credit (CICP).

Portafolio learned of a draft decree that the Ministry of Finance is preparing to close the siege on this sector of the Legislature, which did not go down well with the congressmen and led to some of them resigning from said Commission. arguing that the provisions of the laws that regulate the issue are being disrespected.

More information: Budget cut will be 28.4 billion pesos

This draft decree seeks to introduce a modification to article 2.2.1.6.2 of Chapter 6 of Title 1 of Part 2 of Book 2 of Decree 1068 of 2015 Sole Regulatory of the Finance and Public Credit Sector, in which are dictated, among others things, the procedures to summon the CICP and request the final guarantee to make effective the debt quotas that are previously approved in the House and Senate.

“In the event that, having been summoned on two occasions under the established termsin particular in compliance with what is indicated in article 2.2.1.6.7. of this Decree, the Interparliamentary Commission on Public Credit does not render the respective concept in the following thirty (30) calendar days from the date of the second call, the requirement will be deemed fulfilled and the Ministry of Finance and Public Credit may continue with the process. for the authorization and execution of public credit operations,” says the text that would be issued.

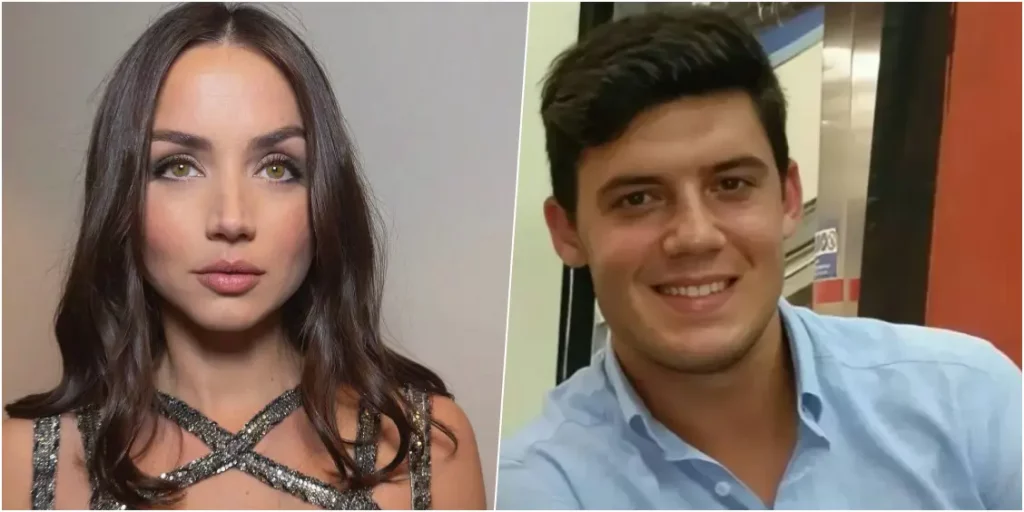

Ricardo Bonilla, Minister of Finance and Public Credit

It should be noted that currently this period of two missed calls is not in the norm, so the Government would gain room for maneuver to avoid delays and in the event that the congressmen of the Public Credit Commission do not attend the calls, it can continue. expeditiously.

This would go hand in hand with what was proposed by the Minister of Finance, Ricardo Bonilla, who on several occasions has said that it is necessary to expedite the procedure that must be completed before the Public Credit Commission to issue debt. We must not forget that this sector of the Legislature and the Government have had friction in recent days because The request to specify the debt quotas already authorized is not supported.

Read here: Companies improve in profits, but not in sales

Legislative changes

However, within Congress there are concerns because they state that this draft decree says that it will change another decree, a norm of the same hierarchical level, but will end up directly impacting Law 51 of 1990, which is of a higher rank, which is not It could, since that would require a new bill to pass through the Senate and House.

Specifically, article 21 of said norm would be impacted, in which establishes that “in the event that the commission does not meet within said period, or does not comply with the aforementioned concept, the previous requirement will be deemed to have been met,” but a deadline is not set, as sought with the draft decree.

The Public Credit Advisory Commission is an interparliamentary body that is composed of six members elected by each of the Third Constitutional Commissions, known as economic commissions of Congress, and will consist of three members from the House of Representatives and three from the Senate. of the Republic.

Colombian pesos

According to the rules of the Legislature, through this team of congressmen, “external credit operations authorized by law to the national government will be monitored, whose purpose is to obtain resources for the financing of development plans. economic and social improvement and to contribute to the balance of payments.”

However, the Government sees it as a “toll” that only slows down the process of issuing credit and managing the Nation’s finances, given that many of the things that are approved there have already been approved by Congress in full. and, as has currently happened, delays are generated in the process.

You may be interested in: Financing Law: the effect that the proposal would have on the income tax return

As Portafolio was able to verify, this draft regulation that prepares The Minhacienda has not been socialized with all the members of the CICP, but among those who know it, there is a majority discomfort, since they argue that the refusal to move forward originates from the fiscal risks that the country faces and the destiny that is assigned to it. wants to give to the debt that the Minhacienda needs.

Concerns in the Commission

According to sources from the Public Credit Commission, one of the fears for which they have kept an eye on the management of the debt quota has to do with the destination of these resources, since more than 90% would go to pay debt , so it would not become an engine that boosts economic growth.

Debt

As they explained, the money that the Minhacienda is looking for would be exclusively to meet previous obligations, so it is not monetized or converted into pesos to finance national projects, which limits the Government’s ability to generate productive investment and reaffirms the pressure of the external debt, which these congressmen described as “dangerous.” .

Furthermore, the lack of foresight in the management of public spending is questioned, given the absence of firm measures to freeze key resources from the beginning led to unsustainable financial commitments. This, combined with an apparent lack of control over state spending, has contributed to the current fiscal imbalance, while past decisions, such as the increase in withholdings, are pointed out as factors that exacerbated the crisis, demanding an urgent review of the policy. fiscal.

Finally, they warn that the financial risks associated with excessive debt are significant and that if the country continues to accumulate debt under current conditions, it could face an increase in their risk ratings, which would raise interest rates and the price of the dollar.