Monterrey, NL. The Tax Administration Service (SAT) is transforming its inspection processes with the support of advanced technologies, such as Artificial Intelligence (AI) and machine learning. According to Leonardo Gómez Montero, Fiscal Director of Femsa Retail, This strategy has allowed the SAT to recover 201.6 pesos for each peso invested in inspection as of November of this year, and it is projected that by 2030 this figure will reach 991.2 pesos.

This is what he explained during the conference “Master Control Plan 2025 in an environment of digital transformation”, held at the Coparmex 2024 Business Tax Meeting.

Gómez Montero highlighted that the main objective of the SAT is to maximize collection through tools such as graph analytics (analyzing data in a graph format) and machine learning. These technologies not only identify inconsistencies in the CFDI, but also detect tax evasion practices related to smuggling and front companies, he explained.

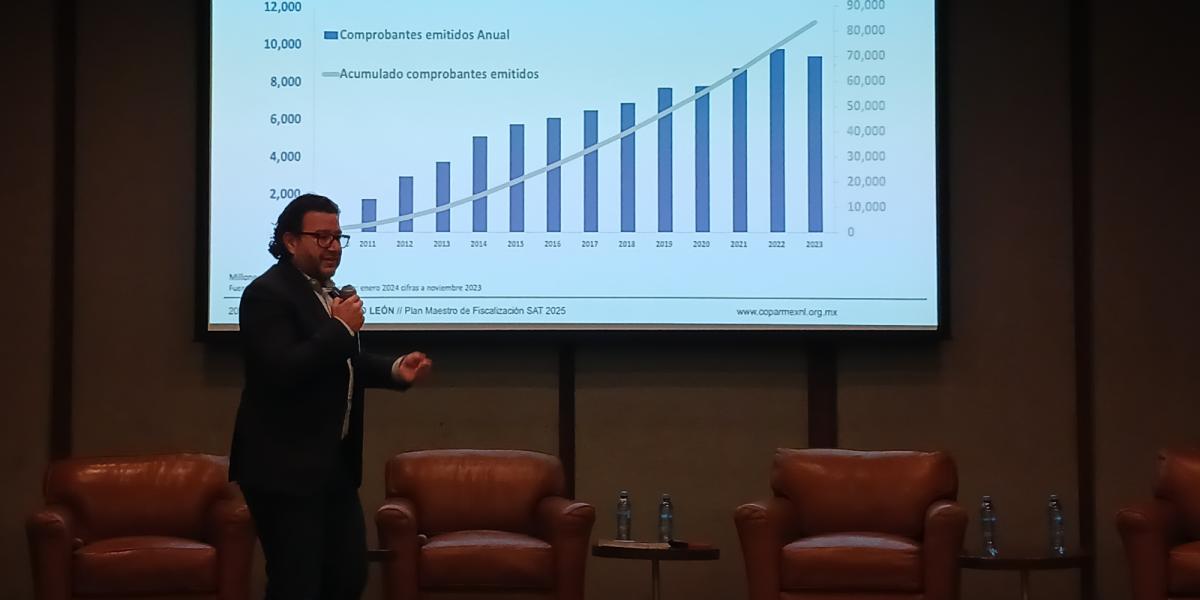

In the 2024 Master Plan, the SAT presented a collection analysis between 2018 and 2023. In that period, net tax revenues increased from 3,062.3 million pesos in 2018 to 4,517.7 million in 2023, with an annual growth of 12.3%. This progress reflects the advantage of the technological investments made by the SAT in recent years.

Technological collaboration and business challenges

The SAT has worked with companies such as Microsoft, which invested 1.3 billion dollarsand seeks to improve Artificial Intelligence infrastructure and promote digital and AI skills.

On the other hand, “the SAT requested a study from Tecnológico de Monterreywhich concluded that it was necessary to standardize electronic invoices and incorporate more complete catalogs. In response, a new version with more than 20 catalogs was implemented, which marked a significant change in the tax collection, the manager emphasized.

However, companies face significant challenges. “With new technologies, the SAT seeks to audit years from previous years, such as 2017, which complicates companies focused on current accounting,” said Gómez Montero.

These technological investments are not without concerns, especially among companies. “The SAT is doing analysis of associates, it could be, for example, the legal representative, and information about him and his links to detect possible tax omissions.