The disbursements made by the financial system, within the framework of the Credit Pact, between September 28 to November 1, 2024, correspond to 13.4 billion pesos, a growth of 25.8% compared to disbursements a year ago.

Read: Financial sector asks to guarantee funds for housing subsidies

The Financial Superintendency said that housing disbursements (excluding infrastructure) grew 39% compared to a year ago.

Likewise, he assured that banks have reduced housing rates, even below the Monetary Policy rate; Since housing loans are long-term, Banks are able to anticipate the reduction of the monetary policy rate even though the cost of funding could be strangling profitability at the beginning of the credit. However, as the credit matures they will make profits.

Disbursements to the Popular Economy are far behind. Disbursements as of November 1st accumulate $30,000 millionwhile its goal is $4.1 billion in February 2026.

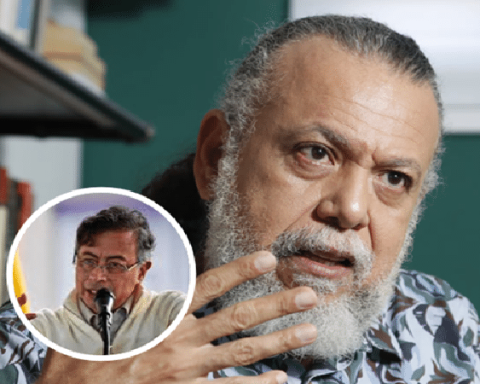

popular economy

Alexis Múnera

That is, compliance with the goal is 1.4% while the other sectors are on average at 10%. Banks should redouble their efforts to meet this goal.

The Productive Colombia Program of the Ministry of Commerce, Industry and Tourism is being contacted, which has been developing work on business assistance, which would allow better identification of demand for this purpose.

Most of the disbursements (69% of the total) are concentrated in 3 geographic areas (Bogotá (30% of disbursements), Antioquia (22%) and Valle (16%)) and in large companies (48%). This situation has improved slightly compared to the previous month.

Read: Grupo Aval expects a growth of 2.6% of the national economy by 2025.

PORTFOLIO