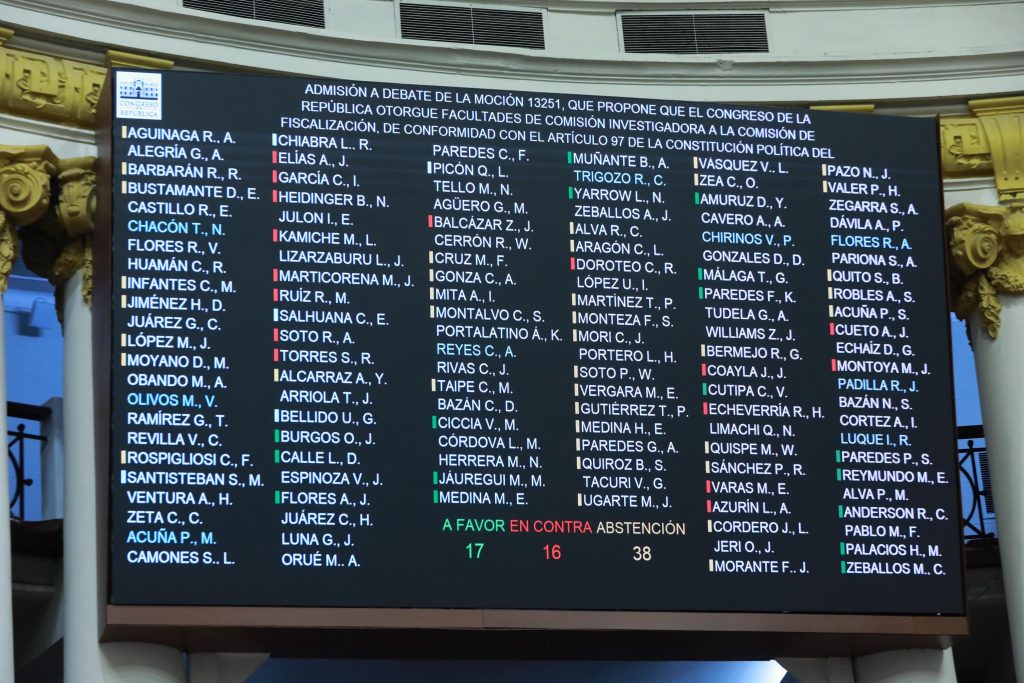

The decision was unanimous.

However, while the Fed’s previous monetary policy statement referred to slowing monthly employment gains, the new one discussed the labor market more broadly.

Although the unemployment rate remains low, “labor market conditions have generally relaxed,” he added.

Risks to the labor market and inflation were “roughly balanced,” the Federal Reserve said, repeating language from the statement released after its September meeting.

The new statement also slightly altered the reference to inflation, saying that price pressures had “progressed” toward the Fed’s target, rather than “progressed further.”

The price index for personal consumption expenditures, excluding food and energy, a key indicator of inflation, has changed little in the last three months, standing at around 2.6% annually in September.

The Federal Reserve’s statement will be interpreted in light of Republican President-elect Donald Trump’s return to power in January.

Trump, who defeated Democratic Vice President Kamala Harris in Tuesday’s election, campaigned on promises ranging from steep import tariffs to an immigration crackdown that could have a broad and unpredictable impact on the economic landscape the Fed will navigate. in the coming months.

Jerome Powell, who was appointed by Trump in his first term to lead the Fed and who later clashed with the then president over rate policy in 2018 and 2019, will hold a press conference.