More than 2,000 officials from the National Tax and Customs Directorate (Dian) will take to the streets of the different cities of the country this week, to respond to an alert that was recently issued by that entity regarding electronic invoicing, since some establishments apparently are not reporting everything they sell.

Cecilia Rico, director of tax management at Dian, said that they will be deployed throughout the commercial corridors to reach more than 27,000 establishments to which in previous days and in constant monitoring, the entity has been able to show that they have drops in the turnover of issuance of electronic invoice, depending on the behavior of your sales or provision of services.

More news: Are trade wars coming back?: global effects that Trump’s return would have

“These control and verification actions of the tax administration, which are part of the institutional strategy ‘Al día con la Dian’, I fulfill the country, aim to guide merchants and guarantee compliance with current tax regulations and that they issue electronic invoices for all their sales,” said Rico Torres.

Thus, the tax authority explained that for this day of visits, the establishments that will be required were selected based on the analysis of information from two (2) sources of information, starting with the number of electronic invoices that each taxpayer to invoice reports, which is contrasted with the dynamics of the sector to which the obligor belongs and its commercial movements.

Income Tax Return

Source: DIAN-Official Facebook

“We also have the valuable reports that users give us. to the institutional WhatsApp number 3108728457, in which businesses tell us that they did not provide them with an electronic invoice or put up barriers to its delivery such as requiring documents and/or additional data or claim to send it to the email provided by the buyer and not They make any shipments,” said Cecilia Rico.

La Dian reported that so far this year it has carried out a total of 106,157 support and orientation visits to commercial establishments, carried out 76,309 interviews with consumers, and verified another 32,660 establishments with low electronic billing turnover.

Also read: ‘We want to know if the Government accompanies us or not in the reactivation’: Camacol

“We take all the information that comes to us and consolidate it by sectional management to generate a clear report on those who are violating the rule, based on the analysis of their purchase and sale movements, of the electronic invoices sent; to the point that we formed a list of sellers of goods and services that are not complying with the standard of generate an invoice for each individual sale,” said the Director of Tax Management.

That said, Dian explained that each person obliged to invoice will be presented during the visit with a report on the number of electronic invoices delivered, which is less than the number of sales made, as well as other indicators obtained based on the information in the declarations presented. and in general of all the information available in the corporate databases; to render his defenses.

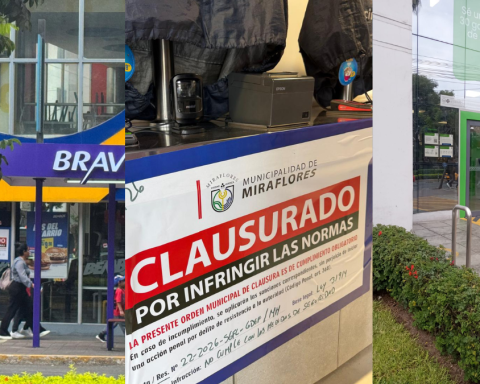

Electronic Billing Monitoring – Dian.

Courtesy – API

Likewise, in the first half of November 400 will visit commercial establishments located in Bogotá, from which complaints were received of non-issuance of the invoice or doing so without fulfilling the requirements, such as: not providing the identification of the buyer or stating a different means of payment than the one made by the citizen, place a QR code that directs to the service rating and not to the Dian platform that confirms the validation of the invoice by the entity.

“It is remembered that businesses should only require from the buyer or service recipient only three (3) pieces of information: name or company name, NIT or identification number and email (this last piece of information depends on the citizen’s preference to receive the invoice; the address only in cases in which you request delivery or home service)”, concluded Cecilia Rico.

The Dian closed by reiterating the invitation to citizens to monitor compliance with this obligation, collaborate with the country in addressing tax evasion, and in the process, generate savings in the tax burden for their benefit by taking advantage of the 1 % on your next tax return by demanding the electronic invoice with the requirements completed and make the payment with an electronic means.

PORTFOLIO