By Walter Vasquez

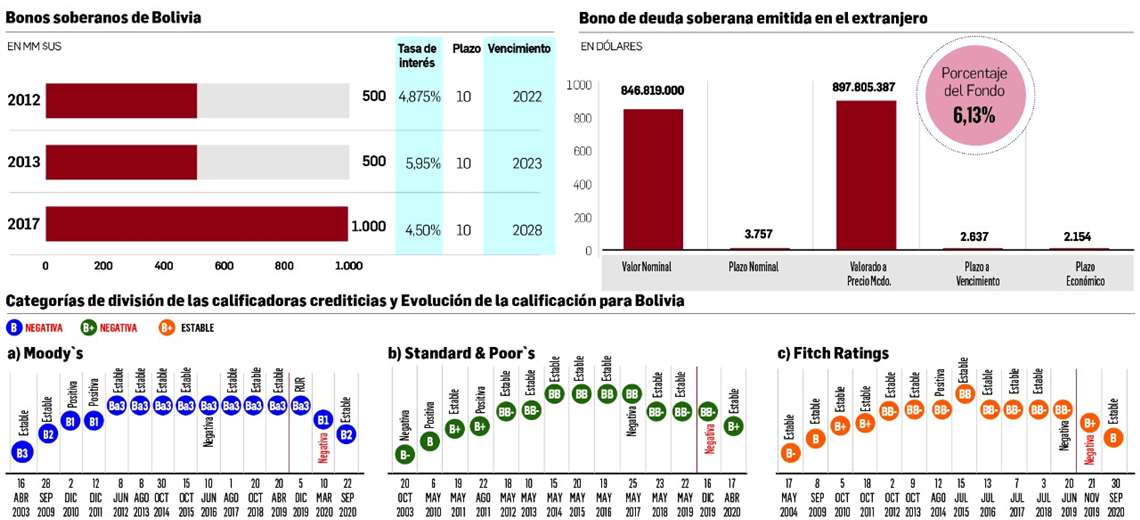

The Bolivian State invested some US$20 million in the issuance of sovereign bonds in the international market, according to analysts who question the success of the operation and ask for the costs of the process to be made transparent. The Government reported that, of the $850 million placed, 796.1 million will be used in the exchange or in the payment of debt and interest.

“You went for $2 billion and got $850 million. That is successful only for someone with a very low standard of success”, considered Jaime Dunn, former operator of the New York Stock Exchange and NSD, who had already predicted days ago that Bolivia would have to pay an additional $350 million in interest for its low risk rating.

“If my son takes an exam for 2,000 points and gets 850, I punish him for donkey (…). The failure of the operation was very big, ”he wrote on his Twitter account.

On Wednesday, the Minister of Economy and Public Finance, Marcelo Montenegro, reported that the country managed to place bonds for $US Bs 850 million of the 2,000 million offered in international markets.

debt operations

“You take 2,000 oranges to market and sell or trade 850. You declare victory by having sold 42%. This is what is known as a Pyrrhic victory. With triumphs like these, we are lost,” said analyst Gonzalo Chávez, who specified that the Government was offered US$1,274 million, but only accepted US$850 million at a higher rate of 7.5% and for a shorter term.

According to Dunn, the US banks JP Morgan, Goldman Sachs and Bank of America were involved in these procedures, as well as law firms from Bolivia and abroad, and computer and communication services companies, among others.

Taking into account the collection of between 1 and 1.5% that banks make for the placement of bonds, “it is possible” that the State has allocated “about $20 million” to this operation, and without bidding through , he claimed.

The 2022 General State Budget Law authorizes the Ministry of Economy to “directly contract” legal, financial and other specialized advisory services linked to the operation of public debt in foreign capital markets.

“That article says that the Government has the freedom to make the contracts it wants and at whatever price. For this reason, it would be important for the Government to explain to all of us how much it cost, because nowhere (in the regulation) does it indicate that this information is a secret,” Dunn asserted.

A note issued by the Bolivian Government in New York on the results of the operation details that of the US$850 million obtained through the placement, US$108.1 million will be delivered in cash as payment for debt and accrued interest; and 688 million will serve for the exchange of liabilities, leaving a total of US$ 53.9 million for budget support.

On Wednesday, in reference to the initial claim to place US$2 billion in foreign stock markets, Montenegro indicated that it is not mandatory to place the full amount. “We have not seen it necessary to continue placing for the bond that is beyond 2028. We believe that the operation is successful because it releases resources that you had to deliver in 2022 and 2023 and you can channel them to productive investment,” he noted.

The minister also stressed that the operation does not represent an increase in the external debt balance, because it is intended for the exchange of sovereign bonds maturing in 2022 and 2023.

In addition to the higher rate, the shorter payment term and the partial placement of the bonds, “the bondholders are all Bolivians. Did they issue domestic debt abroad or what? What a circus,” said economist Mauricio Ríos García, who called the operation a “true failure.”

“Who redeemed them? It was only the AFPs,” Chavez questioned.

Dunn noted that at the moment the Pension Fund Administrators (AFP) “have bought almost half” of the placements of 2012, 2013 and 2022.

“The idea when going out” to foreign markets “is to go into debt, but bringing fresh resources, foreign currency, to the country. With this exchange (of liabilities) Bolivia received about $56 million, almost nothing”, Jaime Dunn considered.

On February 10, the Government announced in the international markets the invitation to purchase and exchange offers of sovereign bonds for $2,000 million with maturities in 2022, 2023 and 2028. The Government had as one of the objectives of the placement to cover part of the $5,015 million of public investment budgeted for this management, of which 40% will be paid for with external financing.

“The markets make decisions considering the future and what happened with the bonds shows what the markets think about the management of the economy that this government will do, not what was done in the transition government,” said economist José Luis Evia.