October 23, 2024, 8:26 AM

October 23, 2024, 8:26 AM

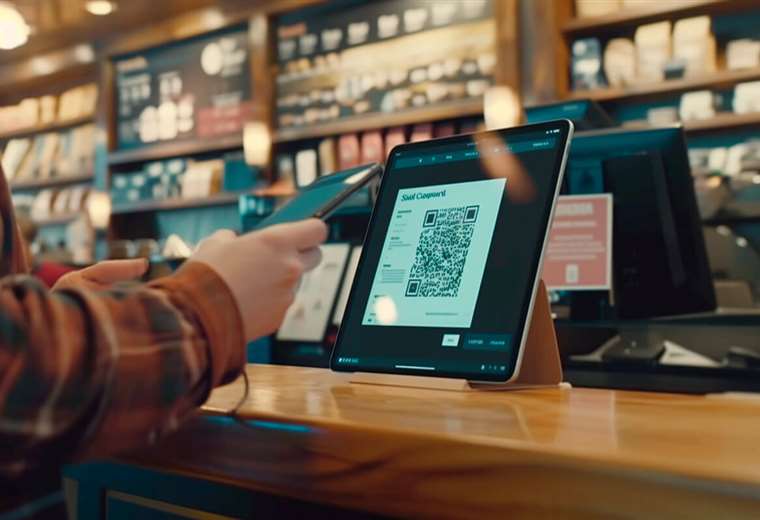

The use of digital payment methods has had sustained growth in the last five years in Bolivia, becoming a safe and fast option to the use of cash; However, it requires more advanced regulations to make an exponential leap.

“We have very great advances in the digitalization of the economy, we see the issue of QR codes and other means of digital payment, formal banking came together to develop this solution that we all now use, and that is a great step that we do not see in other countries, but there is still a long way to go, there are many obstacles that still have to be overcome and that require the analysis of financial regulations in general, which prevents us from moving forward at the pace of other countries,” explains Santiago Laserna, economist and researcher at the Center for Studies of Economic and Social Reality (CERES).

Laserna participated in the “Cochabamba Smart City” discussion, an event prior to the Futures Week, organized by the Franz Tamayo University, Unifranz, from October 22 to 25 in El Alto and Cochabamba.

Data from the Association of Private Banks of Bolivia (Asoban) show that, during the first half of 2024, 82% of all interbank transactions in Bolivia were carried out using QR technology (Quick Response code). and other digital media.

The private entity that concentrates Bolivian banks registered 171 million Electronic Fund Transfer Orders (OETF), with 82% of electronic transfers being made with Simple QR, that is, 142 million transfers, in the first semester.

“Bolivia is a very advanced country in the area of the digital economy thanks to the use of QR codes, however, there is much more that could be done, but we have to update the regulations and generate more modern regulations that include new technologies” says the researcher, who has been studying this phenomenon since 2020, in the context of the Covid-19 pandemic that devastated the world.

Laserna, for example, indicates that it is necessary to think about a regulation that includes the use of cryptocurrencies, whose ban was recently lifted by the Central Bank of Bolivia (BCB), as a means of payment, as well as the development of financial startups (Fintechs ) that serve as digital banks and can manage payments without the need for a bank account and payment gateways.

“From the research, we have seen that in order for exponential growth to occur in the digital economy, it is necessary to release the current regulation, especially to promote the creation of fintechs that do not necessarily support banks, but can function as companies. of financial intermediation alone, that there is a Bolivian Paypal (international payment gateway), which can allow us to carry out transactions without the need to have a bank account. There are risks, but the idea is to create an environment in which the opportunities that give rise to innovation can be fostered,” he explains.

The role of fintechs in financial inclusion

The CERES researcher points out that an improvement in regulation must go hand in hand with the improvement and transparency of the data available on banking access and financial inclusion in the country.

“Currently, we have data on the number of bank accounts that exist in the country, but not on how many people have accounts. This data is necessary to advance the issue of financial inclusion and the digital economy, because it would allow us to have a better overview. “what is needed,” he says.

The World Bank estimates that 1.4 billion people around the world are unbanked. Furthermore, the GSMA (an organization dedicated to supporting the standardization, implementation and promotion of the mobile phone system) and that 345 million of the 400 million microenterprises in emerging markets are informal, which reveals a significant gap in the global financial panorama.

According to the United Nations (UN), micro, small and medium-sized enterprises (MSMEs) represent 90% of companies, more than 70% of employment and 50% of global GDP. Therefore, it is essential that they have access to the resources and tools they need to expand their operations and manage larger product orders and increasing demand.

Given this situation, electronic banking and fintech have emerged as a vehicle for people to access various financial services. The approach of banking to clients, through virtual accessibility, also promotes financial inclusion in the country.

For Laserna, these technologies, added to the use of cryptocurrencies, could allow the inclusion of more Bolivians in digital payment systems, with the associated benefits of greater fluidity in commerce and less dependence on the use of foreign currencies such as the dollar.

“We are already seeing interesting developments with what we currently have, especially in the case of cryptocurrencies, but we still need better conditions, although the risks exist, the opportunities that are generated are important,” concludes the expert.