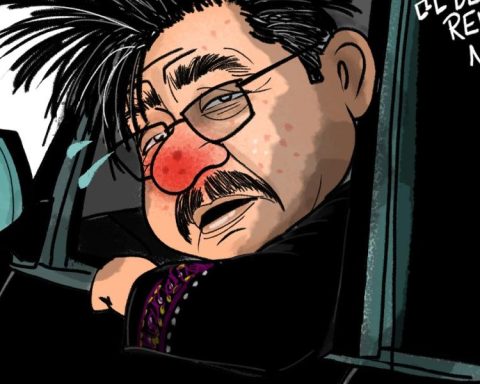

The Financial Superintendent, César Ferrari, said that the usury rate reflects a better reality of the cost of credit in Colombia, so if there are entities that are being affected by their behavior, they must begin to be more efficient and lower their costs. He added that, although it is a situation that cannot change since it is defined by law, if it were up to him he would prefer it not to exist.

(Read here: La Casa de las Carcasas plans to open a production center in Colombia)

The official told Portafolio that financial entities are moving forward and must make the conversion towards greater digitalization and warned that the integration of the stock exchanges of Colombia, Lima and Santiago will not be able to be completed in 2025 as fundamental agreements are needed at the exchange level. tax and monetary policy that is not controlled by the entity it directs.

You say that savings in Colombia is very low, but how can the Superfinanciera do it to increase it?

It is not just the Superfinanciera. We observe that there is a lot of consumption compared to income. The problem is that most of the income does not come from people but from companies. In other countries it is the other way around and that allows tax revenue that lowers consumption. Many things can be said, but it is not strictly a financial issue, but rather a matter of customs.

(See here: Access to genetic resources, at the center of the debate on the second day of COP16)

And investment has fallen a lot. Because?

The one made by the private sector is larger than that of the public sector. But this year there has been a drop in public investment due to the payment of the debt, especially the credit that was obtained during the pandemic for US$5.3 billion and that was agreed to begin paying after three years within a period of two years. .

That didn’t make much sense, since it was thought that everything would be recovered in two years and no one said anything. Private investment has the problem that there is little domestic savings. The savings rate went from 7% in 2023 to 9% in the first half of this year.

Foreign direct investment has begun to decline… That of 2023 was the highest in several years and yes, of course, it falls against 2023, but not compared to the historical average.

Are digital financial entities the future of the system?

I would say yes. We have three digital banks and soon there will be four with the arrival of the British Revolut.

I cannot tell you how long it will take because some will want to continue with preferential service offices and although the costs and initial investment of digitalization are high, later the cost will be marginal and will tend to zero, but they must be converted. It is not a process from today to tomorrow.

Do you think that the integration of the Colombia, Lima and Santiago stock exchanges will be completed in 2025 as planned?

It will not be possible to comply. Stock exchanges that work as a private business are one thing and capital markets are another thing. The good is homogeneous and the prices are the same for the same transactions. But there are different tax rules, because what is in Colombia is not the same in Chile or Peru. It is sold in pesos or in the Chilean or Peruvian currency in dollars, but the legal tender in Colombia is the peso.

Clearly there is an exchange problem that has not been resolved and escapes the Superfinanciera, the same as tax issues. When there is an integration or a merger, homogeneous goods are traded, but in this case they are not homogeneous goods. That does not depend on the Superfinanciera, since it is the central banks and the tax authorities that must speak.

In addition, there is another important issue related to central banks and it is related to the monetary policies of each country, with the issue of monetary issuance. This cannot be resolved with a regulation from the Superfinanciera. There is also the fact that Colombian savings, which represents 7% of GDP, are invested in Chile or Peru.

Will the risk of degrading the Colombian market return to Frontera?

We managed to avoid being demoted from a developing market to Frontera because liquidity recovered a little, but that does not mean that if we let our guard down they will not threaten us again. We are so fragile, despite the efforts that are being made.

Caesar Ferrari.

Those who give credit must lower costs and be efficient

Are they going to modify the calculation of the usury rate?

Small banks, which have small business consumption niches, lowered costs to stay below the usury rate and accommodate the rates. A small bank has to go look at the borrower and verify one by one and that costs them more and is left with high costs, and by lowering the rate that compressed their results.

Those left with high costs have to look at those cost structures or exit the market. We do not have to meet the needs of any bank, but rather the prices. Those who provide rural productive credit have been left almost alone by the costs of their companies. What I tell them is that they have to be more efficient and change the way they lend. For me the usury rate should not exist. The market must be free and everyone must adjust their costs. But it is a legal problem, I (the Superfinanciera does not have) the ability to change the law.

HOLMAN RODRÍGUEZ MARTÍNEZ

Portfolio