The members of the central unions They requested this Wednesday to the Commission of the Treasury of the Chamber of Deputies not to raise taxes on food of the family basket and at the same time they asked for salary improvements for the employees of the sector public.

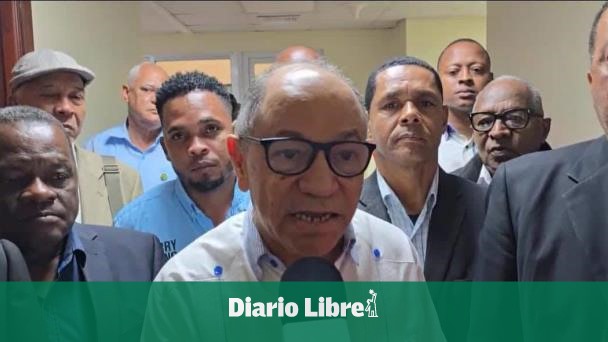

Rafael “Pepe” Abreu, president of the National Confederation of Trade Union Unity (CNUS), expressed that the food, Like soft drinks, they cannot be taxed, because 80% of the working class’s income goes to those expenses. That would reduce earning capacity.

The leader also requested that the increase in salary minimum of sector public be extended to those who earn 30 thousand pesos, including those pensioners and retirees who are in that category.

Likewise, Abreu requested that the indexing salary, which since 2017 has been stagnant. In his opinion, failure to take these recommendations into account could create a instability social in the Dominican Republic.

Free zones and Adoexpo

On Wednesday afternoon, the Dominican Association of Zones Francas (Adozona). Its executive vice president José Manuel Torres is aware of the need to collectionbut expressed that the tax reform project could affect the installation of new parks industrial.

You also understand that it is not appropriate to change the frame legal that favors sector for up to 15 years, but the impact would be on new projects.

“I believe that what we must do as a country is to foster a favorable environment for investment, like the one we have right now so that the investments continue to arrive. investments“Torre said.

He defined the sector of free zones as an enclave that hosts 860 companies, 85% of which is foreign capital, and which contributes around 200 thousand jobs direct formals.

Likewise, the Dominican Association of Exporters (Adoexpo) reported the increase in costs with the tax reform. Karel Castillo, president of the Board of Directors of the entitystated that if all costs they go up it will be difficult compete with other countries.

For this Thursday, the Commission of the Treasury will hold a public hearing, in which the population You can go express your points of opinion on the tax reformthrough which the Government plans to raise some RD$122,000 million.