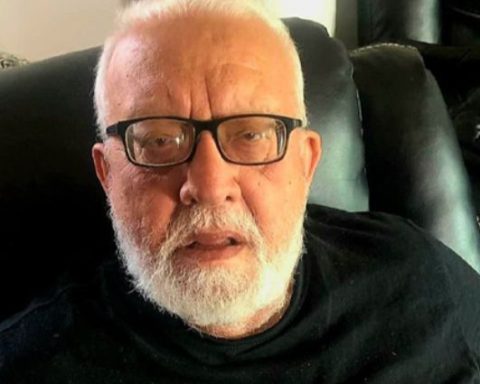

Santo Domingo.- The president of the Federation of Small and Medium Dominican Entrepreneurs (FENAPYMED), Carmelo Rodriguez, highlighted the benefits of Axis #4, one of the key proposals for tax simplification within the framework of Fiscal Modernization.

The proposal of Axis #4 eliminates unnecessary administrative procedures, facilitating the registration and management of tax obligations for small and medium-sized businesses.

He indicated that the simplification of these administrative procedures will allow entrepreneurs to dedicate more time to the productivity of their businesses, which will translate into better financial results.

He said that this initiative seeks to strengthen the competitiveness and sustainable development of Micro, Small and Medium Enterprises (MSMEs) in the country.

«Tax simplification represents a fundamental step for tax relief and the formalization of MSMEs, favoring their inclusion in the market and promoting a fairer and more accessible business environment»Rodriguez added.

Among the specific benefits are reduction of bureaucratic procedures and at the same time eliminates unnecessary administrative procedures, facilitating the registration and management of tax obligations for small and medium-sized entrepreneurs.

He maintained that with the new regulations, MSMEs will have access to temporary tax benefits for those who formalize them, which will not only encourage the creation of new companies, but will also strengthen collection by increasing the tax base.

He assured that in the same way, with the implementation of technologies, greater transparency and efficiency will be achieved since the tax declaration and payment process will be simpler, which will reduce the possibility of errors and provide greater legal security to businessmen.

Another aspect that stood out is that the new law will considerably improve the creation of new formal jobs, thus strengthening the business fabric of the Dominican Republic.

The president of FENAPYMED recalled that since 2012 he had requested the government in power to eliminate tax advances, a burden that has represented a significant obstacle to the cash flow of MSMEs. According to Rodríguez, “eliminating this requirement is an essential step to improve the liquidity of small and medium-sized entrepreneurs, allowing them to invest more in the growth and development of their businesses.” The implementation of Axis #4, which simplifies tax processes, represents progress towards the adoption of fairer and more efficient measures for the sector.

Read also: Cacerolazos in Santo Domingo against tax reform