The economist and researcher, Pável Isa Contreras, stated that the aim is to resolve priorities in an equitable, efficient and sustainable way and finance what is important. He indicated that it will also improve the quality of the tax system, because it closes the holes through which many resources escape.

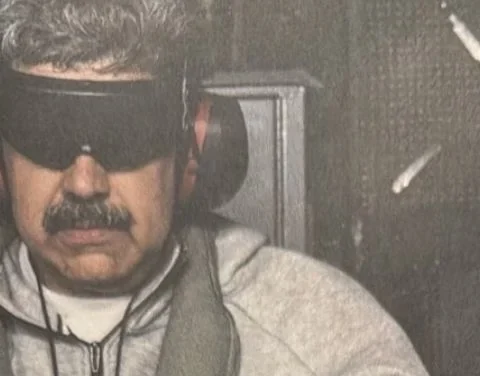

The Minister of Economy, Planning and Development, Pavel Isa Contrerasexplained the scope of the proposal tax modernization presented last Monday by the government whose fundamental objective is to resolve the collective problems of the population and improve the quality of the Dominican tax system.

Isa Contreras, interviewed separately in the programs “El Día” on Telesistema, channel 11 and “El Gobierno de la Mañana”, which is broadcast on the station Z-101, highlighted among the priorities identified in the proposal: strengthening public services, such as health, the mass passenger transportation system in the urban area, citizen security, more resources for city councils to improve their financial and institutional capacity, improve the distribution of electricity and water and sanitation.

“These are the problems that we have to face collectively and that we cannot solve individually,” said the economist and researcher.

He maintained that it is a balanced proposal that “comes to solve the collective problems of everyone.”

He pointed out that efforts are made to ensure that the financing of these priorities is not paid with debts that end up compromising future generations and that the idea is to reduce that part and expand financing with own resources. He indicated that the proposal also proposes increasing flows to capitalize the Central Bank, which will contribute to lowering the interest rate.

The economist and researcher stated that the aim is to resolve priorities in an equitable, efficient and sustainable way and finance what is important. He said that the proposal will also improve the quality of the tax system, because it closes the holes through which many resources escape.

“By closing these holes and equalizing the load, I understand that income will grow faster than the economy, we are talking about an increase equivalent to 1.5% of GDP, 122 billion pesos,” he explained.

The minister said that, although the collection rests mainly on the ITBIS, it gives people back purchasing power with the proposal for a significant salary increase in the public sector minimum wage that will especially compensate for pensions and also an increase in transfers.

The treasury: a saw to contribute together

The economist and researcher defined the treasury as “a saw destined to contribute among all the provision of quality services such as health, water and infrastructure, public safety, energy and urban transportation, and then agree on how we want to finance all this and how to do it.” “We’re going to do it.”

In that sense, he assured that the Dominican State does not have the resources for this large social debt, despite the efforts it is already making in various areas of the national economy, as well as the cuts in advertising expenses.

He gave as an example the government’s efforts to save public spending and invest in priority areas, as well as the project to merge some public institutions as part of the first wave of rationalization of the entities that make up the State administration.

“Despite all the efforts to reduce spending and stop waste, it is still insufficient,” said Isa Contreras.

He highlighted that the Dominican Republic is one of the countries in the region that allocates the least resources to solving collective problems.

He added that the tax modernization bill proposes the solution of fundamental aspects to increase people’s quality of life.

“That when people get up in the morning there is permanent water in the tap, that they also enjoy permanent light, and that they go out into the street and know that their lives will be protected through efficient public security,” concluded Isa Contreras.