Santo Domingo.-The Government intends to present today before the National Congress its proposed law that it has called “Fiscal Modernization”, which has the estimated goal of raising 122,486.6 million pesos.

The project contemplates the elimination of most tax exemptions and expanding the base of the Tax on the Transfer of Industrialized Goods and Services (Itebis), which if the reform is approved will be called Value Added Tax (VAT), as it is known. called in other countries.

According to the project presented yesterday, the Itebis exemption would only be maintained for basic food products: rice, bread, chicken, milk, eggs and bananas, as well as inputs from the agricultural sector.

Among the compensatory measures, the elimination of the advance payment to microenterprises and reducing the proportion of the same to small and medium-sized companies was announced.

Likewise, the elimination of the tax exemption for online purchases of less than $200 is proposed.

Likewise, the proposal reduces the exemption from the Real Estate Property Tax to only 5 million pesos, which includes most middle-class homes.

Likewise, the proposal establishes that vehicles more than five years old, which today pay 1,500 pesos, will from now on pay 3,000 pesos and those that are less than five years old will pay 6,000 pesos instead of the 3,000 pesos they pay now.

The project also proposes reducing vehicle exemptions for legislators from two to one, eliminates exemptions to the Cinema Law, establishes a 20% tax on electronic cigarettes, imposes a tax on sugary drinks and eliminates exemptions for machinery.

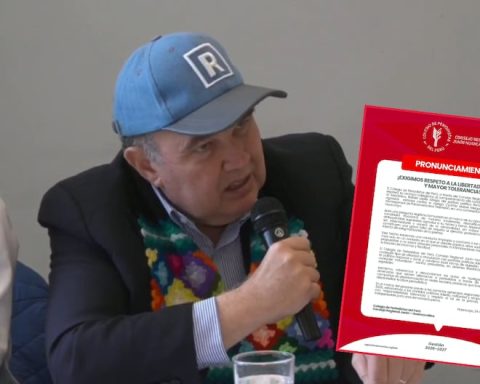

The Minister of Finance, Jochi Vicente, explained that the fiscal modernization proposal is based on four axes: social protection and increase in the minimum wage, public investment programs and prioritized expenses, rules of the same game for all and combating evasion. tax and simplification and tax measures.

“We assume this reform as an act of political responsibility. We are convinced that it will have an important impact, that in the medium and long term the benefits will be evident,” said President Luis Abinader, after Jochy Vicente, Minister of Finance, detailed the details of the proposal.

The presentation lasted more than two hours.

The official, who assumed the spokesperson at the La Semanal meeting with the Press, explained that the project “will act as a mechanism that enables the State to respond to these demands and allows us to be a more developed and equitable country. This reform is not an end, it is a means to achieve the country that Dominicans deserve.”

Social protection

During his presentation, Vicente pointed out that as part of the reform, social aid will be increased to compensate for the effects that occur due to the generalization of certain taxes on certain products and services.

He indicated that the allocation to the Aliméntate program will go from RD$1,650 pesos to RD$2,000 pesos, for an increase of 21%, “this implies an increase of more than RD$5,000 million per year in this social assistance program.”

Another compensatory measure that the Government proposes as part of the reforms is a significant increase in the minimum wage of the non-sectorized private sector.

“We will allocate funds to increase the minimum wage in the public sector to raise it from the current RD$10,000 pesos to RD$15,000 pesos,” he stated.

Public investment

After various consultations and analyzes carried out by the entire Government team, the minister argued that the scope of this problem, as an illustration, in the “budget for this year 2024, almost 263 billion pesos are contemplated just for the payment of interests.

This represents almost 22% of the General State Budget. We must change this trajectory to guarantee macroeconomic stability.”

Attack on evasion

Tax evasion and non-compliance is another element contained in the proposal. They contemplate improving the supervision and control of compliance with tax commitments for legal entities and individuals.

Measures

— Implementation

The General Directorate of Internal Taxes (DGII) will also implement a new income collection system to close the circle of evasion of those taxpayers considered high risk.

Tax simplification, fourth axis

Fourth point. Vicente pointed out that this contemplates tax simplification, which establishes that it will restructure the payment of the advance so that from now on individuals and microenterprises are not subject to payment of the advance. That of small businesses will be calculated based on 40% of the income for the period.

That of medium-sized companies, based on 60%, both with quarterly payments. While the advance payment from large companies continues according to the current income tax (ISR) regime for individuals.

A new section is added to the personal income scale for workers with income greater than RD$2.4 million annually and a marginal rate of 27% is established for this new scale.

*By D. Acosta/J. Garcia/K. Hawthorn