The government announced its project reform fiscal which encompasses increases of taxes to alcohol and income, expansion of the tax on the transfer of industrialized goods and services (Itbis), and removal of exemptions tax and advance payments for individuals and microenterprises, among other measures.

The tax package is contemplated in a call Tax Modernization Law which the Minister of Finance, José Vicente (Jochi), explained yesterday afternoon in the presence of the economic cabinet, President Luis Abinader and Vice President Raquel Peña during a busy press conference.

Apart from the tax increases, the reform proposes the persecution of the evasion and the modernization of the tax system and tax. The elimination of the exemptions will affect the industry textiles, cinema and cultural patronage. The incentives for the installation of industries in the border area are also modified, which from now on will apply to investments of more than five million dollars and that generate 100 local jobs.

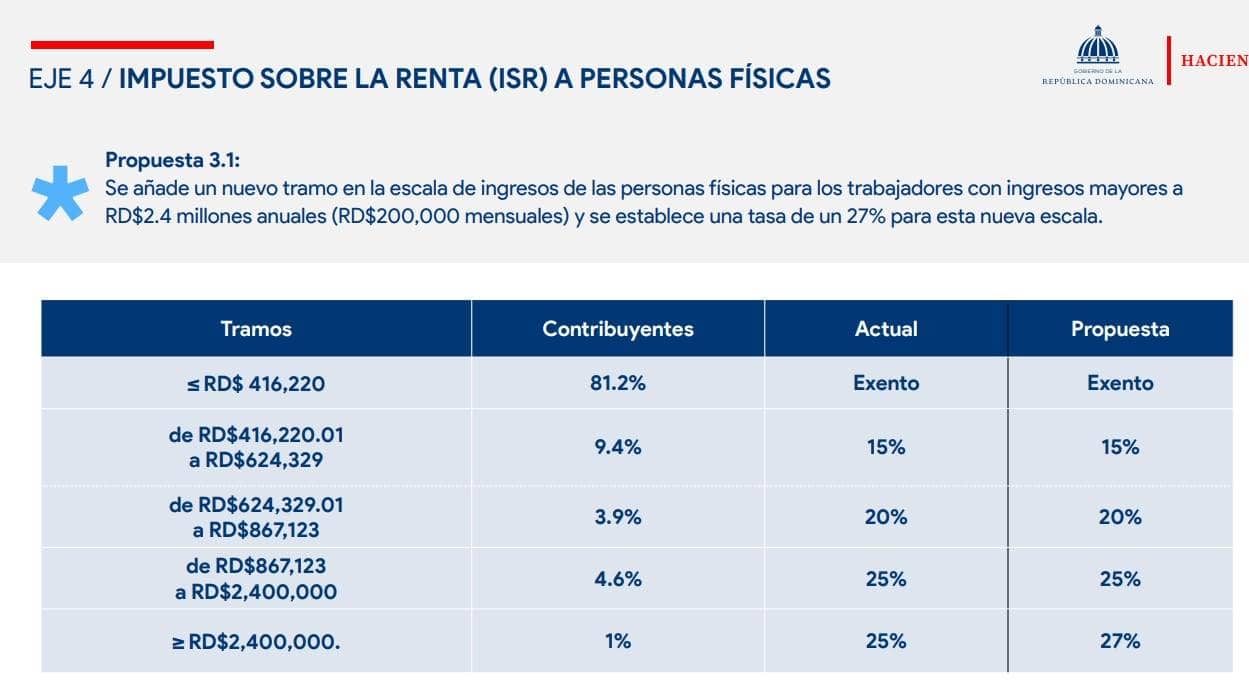

The income above 200,000 pesos per month will be affected by the new proposals and the tax will rise up to 27% based on a scale progressive. Another tax touched by the reform will be the one concerning the property real estatewhose base exemption It will be located in properties of up to five million.

From now on, the obligation to present statement annual sworn for workers in a dependency relationship whose income exceed 624,329 pesos annually. There will be no deductions for educational expenses.

Of the Itbis they will only be exempt livestock inputs, fuel, medicines, fertilizers and their components, insecticides and others, and agricultural capital goods. Of the foodstuffs, bread, rice, chicken, milk, eggs, bananas and cassava will be excluded. Also health, electricity, drinking water, garbage collection, passenger transportation, financial intermediation and insurance, housing rentals for family use and pension and retirement plans.

The imports of merchandise categorized as “low value shipments” worth less than $200 will pay the Itbis and the selective consumption tax. For the drinks alcoholic beverages, a specific tax of 840 pesos per liter of absolute alcohol and an ad valorem of 11% are contemplated.

-

The license plate for vehicles up to five years old will be 6,000 pesos, and for older vehicles, only 3,000. Soft drinks will also be taxed.

The exonerations of vehicles to legislators will be eliminated and replaced by an allocation at the beginning of the period, while electronic cigarettes will be affected by a tariff of 20%.

The associations without ends profit They will only benefit from the exemption of income tax as long as the benefits produced by its operations are not transferred to natural or legal persons.

The taxes to avtur, which penalized airlines, are reduced by half.

With the announced reforms, the Government expects to raise an additional 1.5% of GDP, that is, 122,486.6 billion pesos.

The Minister of Finance, Jochi Vicente, during his presentation explained that among the contributions made by the Government within the framework of this fiscal modernization are: 1- Fiscal responsibility law, which puts a cap on the annual growth of public spending in order to obtain a reduction in the debt ratio; 2- State Reform, through the merger of three ministries, the merger of four institutions for greater efficiency and the elimination of eight institutions; 3- Measures to contain public spending.