He Central Bank of the Dominican Republic (BCRD) reported this Monday that it reduced its monetary policy interest rate (MPR) by 25 basis points, reducing it from 6.75% to 6.50% annually.

Likewise, the rate of the permanent liquidity expansion facility (1-day Repos) goes from 7.25% to 7.00% annually, while the rate of remunerated deposits (Overnight) is reduced from 5.25% to 5.00% annually.

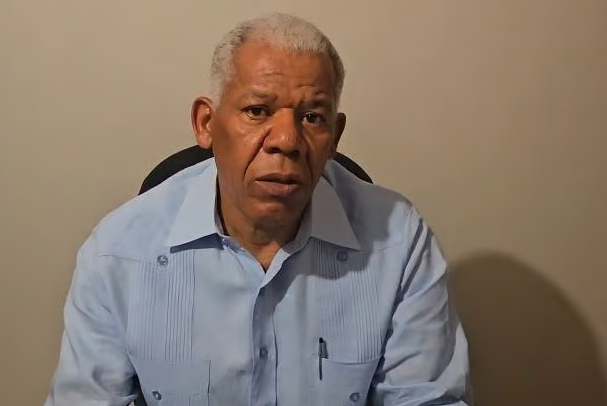

After this announcement the economist Juan del Rosario explained that this decrease translates into positive effects due to the interest rate of new financing that will be lower.

“Banks never call you to lower the rate but generally it is closed to 2 and 3 years, so new loans can go at a lower rate,” he indicated.

Meanwhile, “the negative effect it has is that the prices of goods and services that affect everyone you consume could increase.”

«When the bank reduces the monetary policy rate, what it is doing is indirectly promoting an increase in the amount of money circulating in the economy, when the amount of money circulating in the economy increases. economythen the demand for goods and services increases and that translates into an increase in internal prices,” he explained.

The financier also understands that “although it is true that this measure can stimulate demand and private consumption of the families“It is no less true that this can have a collateral effect, which is an increase in the prices of goods and services.”

For Del Rosario “there is the possibility that this reduction in the monetary policy rate will translate into an increase in prices at the end of the economy, which would be added to what is produced each year and that is that prices tend to increase because the rise in goods and services increases due to the issue of Christmas«.

«The reduction of the monetary policy rate from 6.75 to 6.50 as a way to stimulate consumption, together with an increase in the exchange rate above 60 percent, could translate at the end of the year into an increase in the price of the economy which could be affecting the purchase of the Dominican family,” he added.

“With low rates that is an attraction for people to begin to acquire goods and services and demand them, so when you demand a lot in a market and there is little supply, prices rise,” he concluded.

Bank interest rate increases, despite reduction in the Central Bank rate

The economist Haivanjoe Ng Cortiñas warned of a disconnect between the decisions of the Central Bank and the real effects on the banking system.

According to the expert, despite the fact that the Central Bank of the Dominican Republic reduced its monetary interest rate from 8.5% in June 2033 to 6.5% currently, the interest rates applied by commercial banks have continued to rise, instead of decreasing.

«Since the Central Bank began to lower its monetary interest rate in June 2033, from 8.5% to 8.0%, expecting a reduction in the banks’ interest rate, this rate has not been reduced, since in June 2023 errs by 12.41% and now it is 15.47%, that is, it has increased more than 3 percentage points, instead of decreasing, which was the purpose,” explained Ng Cortiñas.

«Given the null effect of the reduction in the monetary rate of the Central Bank towards the lowering of bank rates, means that users of bank credit have not benefited from loans at a lower cost, a sign of how ineffective the transmission mechanism has been,” he added.

This increase, according to the economist, reveals that users of bank loans, such as credit cards, mortgage loans and commercial loans, have not received the expected benefits of the Central Bank’s rate reduction.

«The Central Bank has the challenge of getting the banks’ interest rate to drop, because in the meantime the users of the credit cards, “Mortgage loans, vehicle loans and any other commercial or productive loan will not have any benefit from cheaper money when borrowing, which can harm demand,” he stated.

For Ng Cortiñas, the outlook short term It’s not encouraging.

“I have no expectations that the bank interest rate will drop and benefit credit users, especially given the imminent tax reform, which is generating uncertainty in the market’s economic decisions,” he stated.