Anauco, which has led the lawsuit, says that The process has lasted more than five years, seriously affecting the economy and health of the depositors, so it was necessary for the court to establish clearly and definitively whether the bonds with which the shareholder proposes to pay really exist.

This Friday, September 27, the meeting of creditors of Banco del Orinoco, NV (in the process of liquidation) was held at the headquarters of the Court of First Instance of Curacao.

The meeting was called to vote on the “Composition Plan”, originally proposed in December 2023 by the bank’s shareholder, Cartera Venezolana de Inversiones, SA, better known as Grupo Financiero BOD.

Various lawyers representing the depositor creditors, mostly Venezuelans – given that Banco del Orinoco, as an offshore bank, houses the funds of more than 2,700 people and companies – attended the meeting.

Anauco was represented by lawyer Roberto León Parilli, who attended on behalf of 521 creditors, duly accredited with the mandates granted for this purpose, according to a press release.

The plan presented in December by the bank’s shareholder contemplated a period of up to five years for the return of money to depositors, and proposed mechanisms that did not have the support of those affected. Anauco, along with other creditors, had submitted observations and requested amendments to ensure that the agreement included greater guarantees and more favorable conditions.

However, at this Friday’s meeting, the shareholder did not present any amendment in response to the depositors’ demands. As a result, the original proposal was not qualified for a vote.

*Read also: Group of BOD victims in Curacao ask the court to register their debts

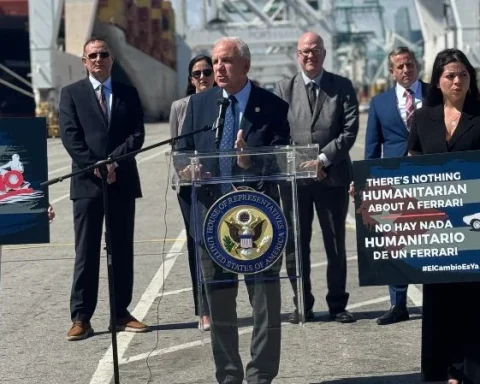

However, the court, accepting the recommendation of the liquidation trustees, ordered the BOD Group to, within a period of 15 days, present evidence of the existence and quality of the assets with which it intends to respond to the depositors through a verifiable and secure payment agreement.

«This process has lasted more than five years, seriously affecting the economy and health of depositors. It was necessary for the court to establish clearly and definitively whether the bonds with which the shareholder proposes to pay really exist. Now they will have to prove it in the next 15 days«said Roberto León Parilli, representative of Anauco.

Among the positive developments of the meeting, it stands out that the long-term proposal (5 years) presented by the bank’s shareholders has been disqualified. The presentation of a new proposal that is acceptable and has guarantees of compliance and legal transparency has been required.

In the next 15 days it will be determined whether the assets offered by the shareholder really exist. If their existence is confirmed, these assets must be secured to negotiate the final terms of the agreement. Otherwise, if they are not certified, new actions and judicial measures will be taken, the letter states.

Post Views: 196