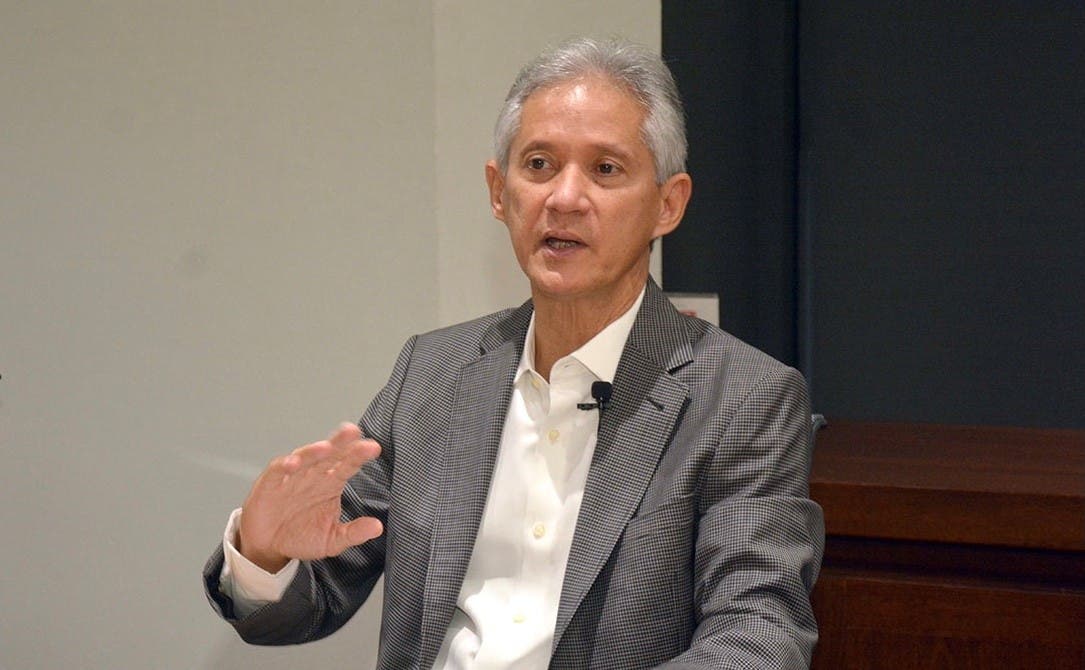

Economist Haivanjoe Ng Cortiñas stated that the tax reform that aims to raise an additional RD$110 billion with the purpose of increasing total Dominican public spending will do nothing to benefit social spending. «The only item in favor of social spending is health with RD$ 10,870 million added, placing it at 10.0% of total spending, even below other pre-pandemic years which reached 11.0%. “With this new amount, public health will not be able to successfully face the great challenges it faces.”

He continued by saying that of the 6 items to which the new tax revenues from the tax reform would go, public health only represents 9.8% of the total, against the 20.0% that will be allocated to the recapitalization of the Central Bank, equivalent to the DR. $22,233 million or double that of public health, which implies a transfer of resources from taxpayers to the holders of investment certificates of the Central Bank and to solve part of the quasi-fiscal deficit of the monetary entity, which contributes nothing to the redistribution of income nor the fight against poverty.

Ng Cortiñas indicated that another item that will not impact the benefit of the lower-income sectors is the RD$11,000 million that will be allocated to city councils or local governments, also an amount higher than that of public health, when the country’s city councils allocate a 75.0% of its budget in current spending, which represents little social return, as the majority of the amount is spent on public payroll, in a scenario in which local governments show strong confidence in the quality of their municipal spending.

The economist also pointed out that another expense that will not impact in favor of the lower-income population is that which would be allocated to citizen security, this being a way of attacking the effect and not the cause that promotes insecurity in the streets and avenues of the country. Citizen insecurity is fundamentally the result of unemployment and poverty, therefore, public spending must be carried out to create productive employment and increase public assets, the economist emphasized, the tax reform would allocate RD$13,043 million to citizen security, almost RD$ 3 billion more than what is planned for public health.

READ: Tax reform: Four measures revealed by the Government

Carrying out a tax reform to raise RD$ 110 billion will collaterally pressure further price increases, since they are resources that are transferred from the productive private sector to the government and businessmen in turn transfer them to the prices of the products and services they offer, This is assuming that the tax reform has a progressive nature. If, on the contrary, the aforementioned reform has a regressive nature with taxes on goods and services that citizens demand, consumers will bear the price increases, affecting the purchasing power of salaries or the monetary income they receive.

For the economist Ng Cortiñas, the tax reform is unnecessary, since the government itself, in its medium-term program 2025-2028, foresees economic growth around the economy’s potential of 5.0 5, while at the same time foreseeing compliance with the inflation goal of 4.0%, so why a tax reform, he asked.