If there are companies that comply with their tax obligations, it is neither fair nor loyal for others not to do so because it generates unfair competition.

The General Directorate of Customs (DGA) and the General Directorate of Internal Revenue (DGII) reported that they are continuing joint operations to detect possible tax and customs crimes by companies operating in the country.

Both entities explained that, given the suspicion of possible practices that undermine legitimate trade, both institutions began a process of inspection of the companies: Plaza Hope by ZZBQ SRL, Comercial WERAYO SRL and Plaza Hope by BZHE SRL.

These audits are carried out in accordance with the provisions of the Tax Code current and the laws that modify and complement it, as well as the Customs Law 168-21 and its implementing regulations, the state’s tax collection agencies stated.

They added that the inspection visits are part of the joint strategy carried out by both departments in efforts to combat tax evasion and unfair competition.

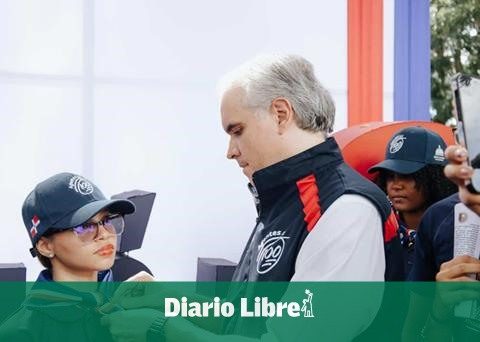

Both the director general of the DGII, Luis Valdez Verassuch as that of the DGA, Eduardo Sanz Lovatonreaffirmed through a statement their role of protecting legitimate trade from those who evade compliance with the law to the detriment of the Dominican State.

Visits and audits to these companies are carried out based on the results of the exchange of information between both institutions.

Tax collection agencies warned that companies that do not have findings contrary to current regulations will be able to continue their operations; meanwhile, those found to be engaging in anti-commercial and tax practices will receive the sanctions provided for by national laws.

Business sectors and industries in the country have complained about the unfair competition that companies that comply with their tax obligations face from those that evade tax compliance in their operations.

If there are companies that comply with their tax obligations, it is neither fair nor loyal for others not to do so, which generates unfair competition, said affected businessmen.