During the last year, insurance companies in Peru covered claims for an amount exceeding 9,678 million soles. More than a monetary issue, the data provided by the Peruvian Association of Insurance Companies (Apeseg) speaks of the importance of being protected against any type of threat that may threaten the life, health or property of people.

According to the Superintendency of Banking and Insurance (SBS), there are 17 registered companies operating in the Peruvian insurance system in the country. An Apeseg report also estimates that at the end of the second quarter of 2024, the annual per capita premium in the Peruvian market reached US$162.

Another interesting fact is that, until last June, annualized net insurance premiums were around S/21,140 million, a figure that represents a growth of 7.9% compared to June 2023. The demand for the insurance branches that increased the most in the last year were life (16.6%) and general risks (6.2%). Meanwhile, accident and illness insurance only grew by 1%. Since March 2023, SPP insurance continues to decline.

Most requested

The wide range of insurance policies available in the country covers a variety of aspects, from protecting the physical integrity of clients and their families to the assets (vehicles or homes) they own.

One of the most popular and sought-after insurance policies is life insurance, which is part of personal insurance. In general terms, this provides designated beneficiaries with financial protection in the event of the death of the insured. Coverage may apply for natural death or illness, accidental death, or in the event of partial and permanent disability, depending on the plan contracted.

In turn, life insurance is divided into three: whole or permanent life insurance, temporary or time-limited life insurance, and savings or return life insurance, which allows you to be insured and at the same time generate savings for the future.

“Until last June, annualized net insurance premiums were around S/21,140 million, a figure that represents a growth of 7.9% compared to June 2023.”

Another option is also offered, called private annuity, which has been in high demand in recent years. In this case, the insured or his beneficiaries receive a periodic income for the agreed investment, which may be for life or for a period of time, in its deferred or immediate forms. An important detail that differentiates private annuity from traditional savings products is that they offer a guaranteed return during the term of the contract. This allows the insured to protect themselves from the risk that interest rates or the profitability of their investments may decrease during the contracted period. The type of currency is at the client’s discretion.

Insurance: Innovation in products and communication

Technology and customization mark the way forward.

At the end of 2023, the SBS released the results of the Insurance Demand and Knowledge Survey. It was found that currently only 3 out of 10 Peruvians have insurance: 17% reported having personal insurance and 10% having some type of property insurance, whether paid for by themselves or by a third party. On the other hand, only 29% of respondents trust insurers.

Despite the still low penetration of these products, the SBS mentions that the insurance system shows a clear growth trend. In September 2023, the number of policies issued amounted to 46.3 million, 1.55 times greater than that registered in September 2014. The figures mentioned are encouraging, but it is urgent to attend to users who are less economically favored and more vulnerable.

Microinsurance is aimed at this sector, designed to respond to the protection needs of low-income people and small businesses. This inclusive approach not only promotes a culture of insurance and prevention, but also consolidates innovation as an important tool for the strategy of attracting and retaining clients.

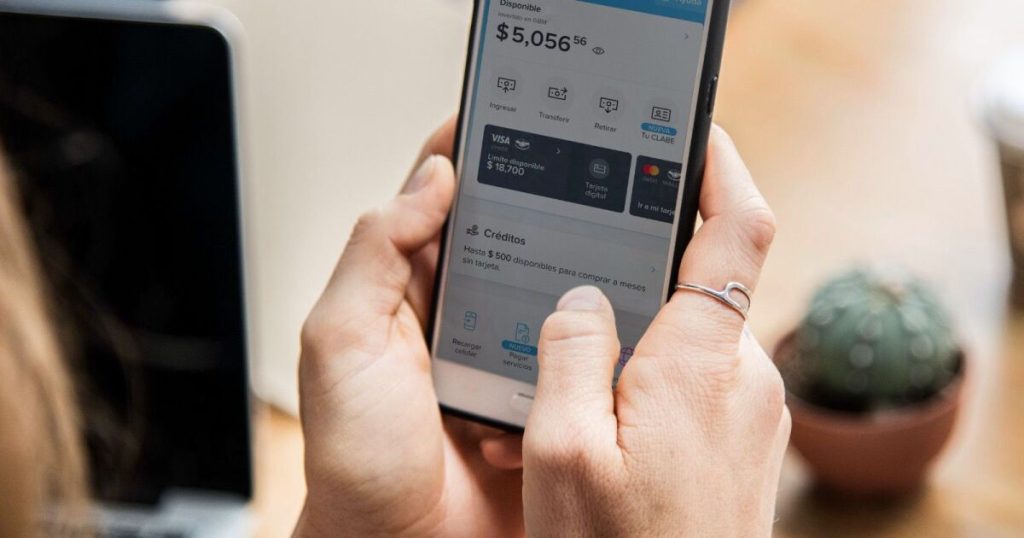

In this context, technology and communication channels between insurers and policyholders are vital. At the pace of the great changes that virtuality has generated as a lifestyle in terms of experience and expectations, the services and products of the insurance market can and must improve their capacity for immediate response. Simplifying the process of evaluation, admission and use of data from any device is a pending task.

This transformation in the world of insurance companies has brought with it the emergence of insurtechs, startups or companies that combine technological innovation with insurance solutions. These insurtechs have the ability to fully understand the digital needs of consumers and are gaining a place in the Peruvian market, thanks to the fact that they offer smaller, simpler, highly personalized and affordable products.

RECOMMENDED VIDEO: