Founded in December 2021 by two young Colombian entrepreneurs, this Fintech with an international presence completed two years of operation with positive results in its operations and business expansion.

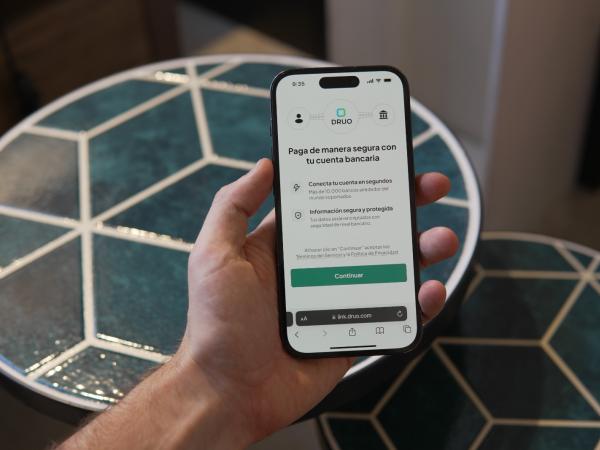

Druo developed a payment acceptance solution for companies through bank accounts that already operates in four countries, including Colombia.

(Read: Bogota’s Minimum Guaranteed Income shakes up: what will change?).

Through its payment system, companies can charge directly to bank accounts, locally or internationally, saving time and costs compared to other options on the market and allowing more customers to pay them using their bank account or digital wallet. Their motto is to make the bank account the most powerful payment method in the world..

In line with this objective, they have managed to have a positive first year of operations after starting operations in the first half of 2022. At the end of 2023, they recorded a seven-fold growth in their revenues, compared to the results of the previous year. During this period, they also had an increase of almost 500% in the processed volume compared to 2022.

This behavior has extended to the first half of 2024, a period in which this Colombian Fintech processed US$ 35 million, tripling this volume compared to the first six months of 2023. In relation to income, it reported a growth of 2.7 times compared to the same period of the previous year, consolidating a 3-digit growth rate for 4 consecutive semesters since its launch on the market.

Druo, financial technology company.

Courtesy

“We have maintained triple-digit growth thanks to our focus on reaching more and more companies across all industries, especially medium-sized and corporate clients in the four countries in which we operate: Colombia, Peru, Mexico and the United States. This is our main objective during the second half of the year,” highlights Simon Pinilla, co-founder of Druo.

The Fintech plans to close this year with equal or greater growth compared to its 2023 results as it moves forward with its expansion strategy. Its goal for 2025 is to process more than US$300 million, strengthening its operations in the four markets in which it is currently present. and reaching new destinations such as the European Union and Brazil in the first half of the year, where it plans to increase its coverage from 1 billion bank accounts to 1.7 billion.

Its growth strategy also includes expanding coverage in industries. Today it has clients in more than 13 sectors and aims to reach 20 next year.

In addition, it is currently working on the diversification of products and services to attract other user profiles; among these innovations, the international collection service to bank accounts stands out, to collect and pay directly through accounts in any country where the Fintech operates.

Druo, financial technology company.

Courtesy

“In 2025, we will enable new transactional rails in the countries in which we operate, such as the SPI in Colombia, which will bring new technology to facilitate real-time payments for low-value transactions.”concludes Pinilla.

PORTFOLIO