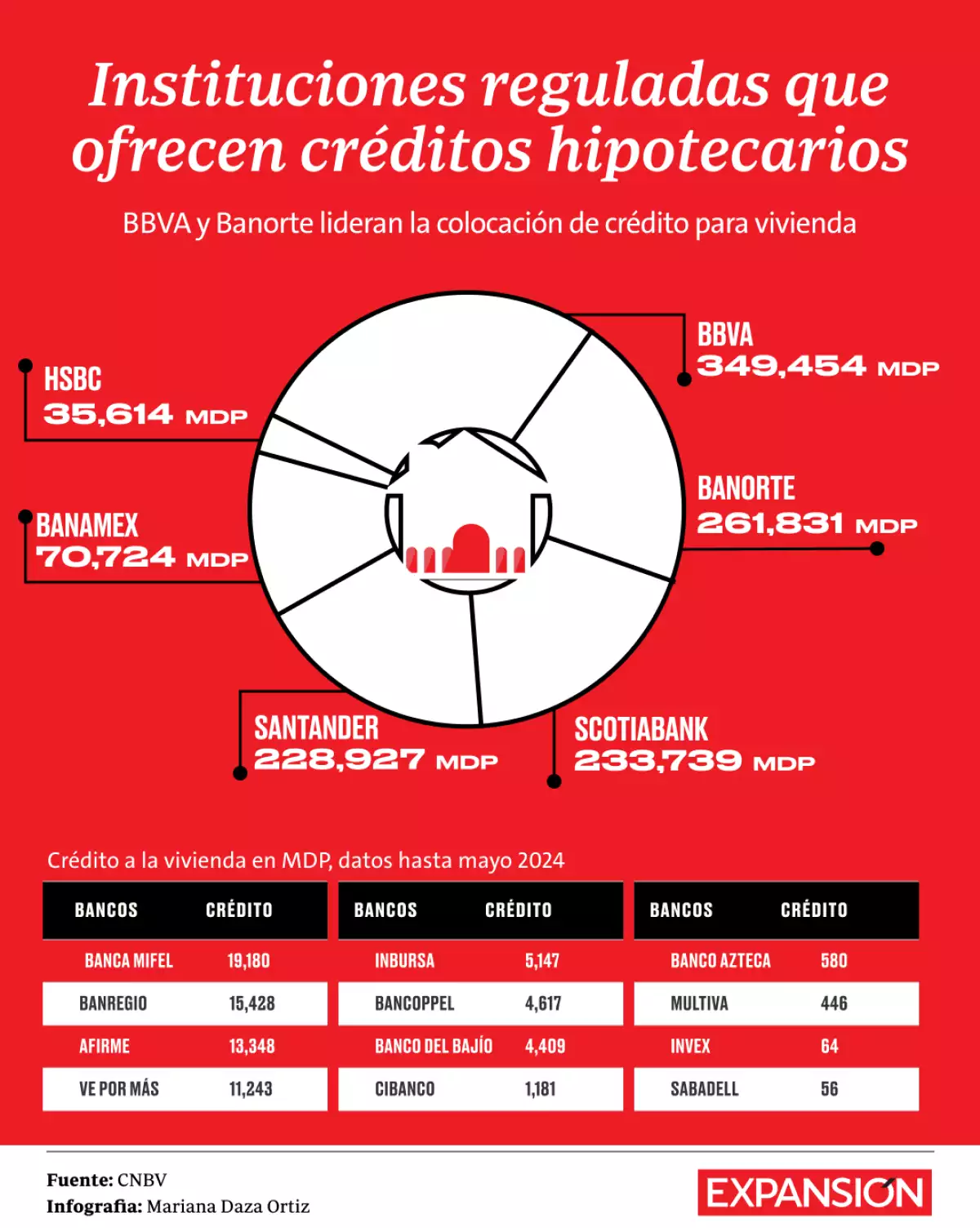

As of last May, BBVA México remained the leader in this segment, with 349,454 million pesos in housing loan portfolio, followed by Banorte, with 261,831 million.

With 233,739 million pesos, Scotiabank is the third bank with the largest housing loan portfolio and Santander was in fourth place with 228,927 million.

The Canadian bank has surpassed Santander since January of this year due to higher financing amounts.

Santander acknowledges that there has been a slowdown in the growth of this type of financing, mainly due to the increase in interest rates. However, for the moment they are not worried about having been overtaken by the Canadian bank.

“Rather than being worried, we want to produce a profitable portfolio, because what can happen if you grow too quickly is that you have to stop giving loans to people you shouldn’t have,” said Borja Serrats Recarte, executive director of Personal Banking at Banco Santander Mexico, in an interview.

“We are satisfied with the progress (of the placement of credit) and we see that the market is a bit stagnant, but I think it is a bit more due to the environment of uncertainty that exists (due to rates). We believe that now in the second half of the year home purchases will accelerate,” said the executive.

Santander offers loans from 250,000 pesos, seeking to reach all segments of the housing market. Interest rates range from 8.9% to 10.25%.

Growth in times of high rates

Experts say that the growth in mortgage lending by banks is due, in part, to the increase in housing prices and high interest rates, since fewer loans have been granted, albeit for higher amounts.

Cristian Huertas, founder of the mortgage broker Morgana, said in an interview with Expansión that the number of loans issued has seen a decrease. “While at the beginning of 2019 there were around 33,000 loans in the first quarter of 2024, the figure is 25,000.”

The specialist highlighted that while in 2019 the ticket The average mortgage loan was 1.1 million pesos, the amount in 2024 rose to 2.2 million.

For Santander Mexico, 40% of Santander financing is for new homes and 60% is for used homes, which in a way demonstrates the lack of supply.

Huertas pointed out that something that has changed is the percentage that banks finance in new and used housing: while eight years ago 80% of the financing was for new housing, now 55% is allocated to new and the rest to used.

“There is not enough housing supply. Not only because developers do not want to build, but because the permits for construction have not been granted, because there must be strong environmental planning for that,” he stressed.

Expansión contacted Scotiabank to find out its position on this type of financing, but it had not responded to our questions by the time this edition went to press.

A business not a business

Huertas pointed out that mortgage lending is not a big business for banks in Mexico. While Cetes offer rates close to 11%, mortgage lending rates are barely 10.5%.

When it becomes a business for banks, it is when the institution offers its mortgage clients a payroll account or a credit card. These are businesses in which the institutions can have a better return.

With the economic trend of nearshoringit is expected that Mexico will be able to take advantage of the real estate sector, although, in Huertas’ opinion, this will only happen if there is collaboration between the government and the private sector.

“I think the next government understands very well that it has to ‘team up’ with the private sector to achieve the ambitious goals they have for housing construction, and to the extent that they are able to execute this housing agenda well, the market will grow,” he said.

Faced with a slowdown in the economy, in which formal employment has performed less well than in 2023, Santander Mexico says it sees no risks to credit. “Right now it is not a concern that we have,” said Borja Serrats.