By Mayelin Acosta Guzman/Kelvin Pascual Polanco

Representatives of the business sector praised the president’s inaugural speech Luis Abinader, They stressed the importance of the government carrying out the tax, labor and social security reforms that are necessary to boost development. Meanwhile, economists were waiting for an explanation of how it will achieve its objectives and called for improved spending and job creation.

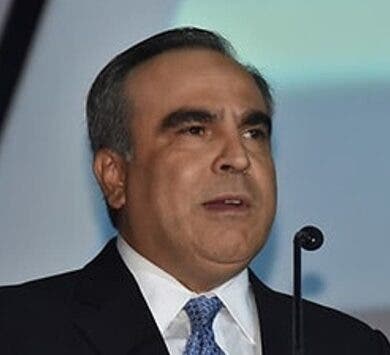

The president of the National Council of Private Enterprise, Celso Juan Marranzinistressed that the country’s political and economic stability is a great opportunity for these reforms to gain momentum and catapult the Dominican Republic from a middle-income country to a developing country. He called for them to be carried out in a process of dialogue.

You can read: Elegance and style! This is how politicians and personalities looked at Abinader’s inauguration

“There are challenges such as raising the quality of education and the fiscal pact that entails a tax reform that includes improving public spending so that more resources are allocated to priority sectors and, above all, working in the electrical sector to reduce losses which have a weight on public finances. In addition, it impacts the growth of the sectors of the economy,” he said.

He stressed the need for changes to be made in the education sector in order to have human capital that supports the expected GDP growth.

The president of the Employers’ Confederation (Copardom), Laura Peña Izquierdohighlighted the importance of the ongoing reforms and any proposal that promotes productive development based on private investment.

He also celebrated the stimulation of entrepreneurship, the improvement of the business climate and the promotion of public-private partnerships.

“At Copardom, we reiterate our commitment to promoting formal employment in the country and strengthening tripartite dialogue to achieve appropriate standards and legislation, including the modernization of the Labor Code, a pressing need today,” he emphasized.

He expressed his confidence in the president’s commitment to modernizing the Labor Code, as expressed in his speech. He also proposed that the president continue to strengthen the Dominican Social Security System (SDSS) and take measures to encourage the formalization of employment.

On the other hand, the president of the National Association of Companies and Industries Herrera (Aneih), Euri Andujarpointed out the importance of opening a dialogue table to achieve the reforms mentioned. Regarding the fiscal reform, he said he hopes that the basic objectives outlined can be reconciled, of healthy public finances by reducing a debt that is growing while ensuring resources for health services, security and infrastructure.

“At Aneih we trust that a comprehensive tax reform will be achieved that is not just a tax collection scheme for those who always pay taxes, but that has a broader scope in which evasion, informality, smuggling and other topics that have been avoided can be reduced,” he said.

And he welcomed the reduction in spending by eliminating institutions that have no reason to exist, or merging with others whose nature is duplicated.

Economists criticize

Although they value the reforms that Abinader intends to achieve for his new government, economists understand that the president did not give clear details of how he would achieve the objectives announced in his speech so that the DR lays the foundations for sustainable development and that there is better well-being for its citizens.

For Magin Diaz, The objectives of reducing the deficit and spending, outlined in the fiscal reform that the government will present, are contradictory. He said that this would only be possible with a very large fiscal reform, which would have to be at least 3% of GDP, which would require, he indicated, a tax increase.

“The reform that is being pursued is going to be very big, meaning that a large tax increase is coming to achieve these two objectives,” he explained. He pointed out that in order to try to affect the most vulnerable population as little as possible with this reform, it would be through increasing welfare, meaning compensating the 40% of the poorest, but that this would have an impact on the middle class.

“There will be no way out with the middle class, so the government will have to explain,” he added.

While Jaime Aristy Escudersaid that Abinader did not go into the details of how he would achieve debt sustainability, reduce the deficit and improve public finances. “You don’t know if he will increase rates, the base or simply tackle tax evasion,” he said.

He said that in relation to spending, the government should focus on improving efficiency, making an impact assessment and a results-based budget, where the impact of each peso paid by the population through taxes can be verified.

Juan Ariel Suero said that the numbers presented by the president on economic matters were only a story that differs from the data. “The story is about historic growth in formal employment, but the data is that formal employment in the private sector is 21,294 jobs below 2019, meaning that what has grown is informality.”