BPS reduced interest rates on social loans from liabilities by four points

The Social Security Bank (BPS) approved in its board of directors a reduction in the interest rates applicable to the social loans it grants, a measure that will take effect starting next week. Debtors who apply for a six-month loan will have access to a rate of 23.5%; for 12 months, 26.5%, and for 18 and 24 months, rates of 28%. Currently, more than 200,000 people have current loans from the institution.

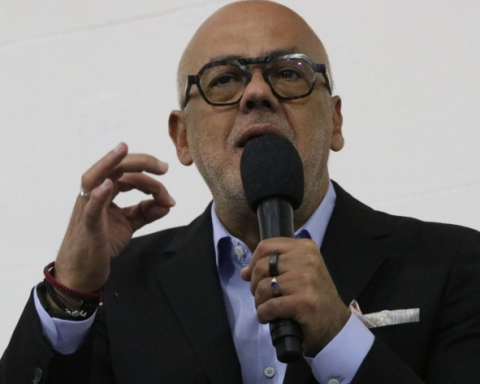

The reduction of four points was made in order to facilitate access to financing for beneficiaries who receive pension benefits, and it covers administrative and insurance costs. The president of the Social Security Bank, Alfredo Cabrera, explained that it was possible to do so because the rates were reduced and the efficiency in administrative management made it viable. “The optimization of management allows us to reduce costs, reducing operating costs, and not make a profit, which is not the point, because they are social loans,” he argued.

With the approved measure, those who apply for a new six-month loan will have to pay a rate of 23.5%; for 12 months, they will be charged 26.5%, and for 18 and 24 months, the value rises to 28%. Those who have paid at least 40% of the original amount will be able to renew the application. In this case, the conditions of the previous one will be eliminated and they will have access to the new rates. The benefit is expected to come into effect as of Monday 19.

Cabrera said that currently about 200,000 people are paying loans to the bank, of which 10,000 have more than six valid vouchers (open loans). In the latter case, they will be offered, starting in September, a single 36-month voucher, extraordinary, at an interest rate of 28%.

“Those people who have a higher level of debt due to the number of loans, will be able to unify everything in a single voucher starting in September, with a longer term and a discounted rate of four points, benefiting from the reduction that we make in all other cases,” the head of the institution added.

People interested in any of these options will be able to simulate, request, renew and view information on previous loans through the online service. Manage my loans on site web from the bank, which they enter with the personal BPS user. In person, they can go to the Social Loans office in the headquarters building in Montevideo, with a scheduled date; through WhatsApp, through which they must send the word Loans to 098 001 997, or by calling 1997 option 2: reservations. Then, option 1: loans.

The president of the bank confirmed that, in addition to collecting the loans at any Abitab, Redpagos or ANDA branch in Montevideo and the interior, they can also be requested there, as long as they are the holders of the loan. In case of requesting them by proxy, they must go to the BPS office to prove their identity. This possibility also confirms the efficiency of the management, he concluded.