Santo Domingo, DR.- The Dominican Pension System continues to be the main promoter of the country’s economic development by providing more jobs, increased national savings, more housing and financial inclusion, through the investments of pension funds in the different national productive sectors. Furthermore, despite the progress that has been achieved, the challenges of low contribution and contribution densities to the system, as well as high labor informality, still persist.

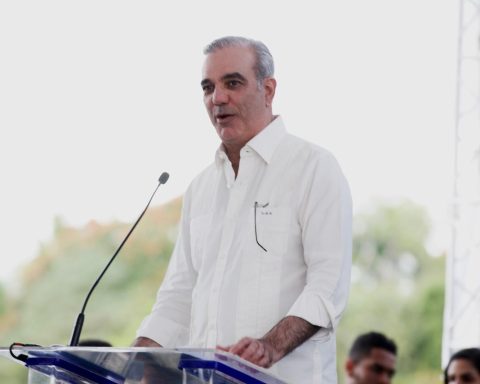

This was reported by Francisco A. Torres, Superintendent of Pensions, during his presentation at the forum “Pensions: engine of economic development and pillar of well-being”, organized by the Employers’ Confederation of the Dominican Republic (COPARDOM).

During the activity, Torres reviewed the current situation, opportunities and future expectations of the Dominican Pension System, highlighting that, despite the fact that 98% of formal sector workers are contributing, the average density is still around 42%, showing very good levels of profitability, being the highest of the countries in the region with pension systems similar to the Dominican one.

He said that the Dominican Pension System has a historical nominal rate of return, higher than 11% and the real rate higher than 4%. With notable advances in terms of diversification of the investment portfolio, given that, investment funds alone, from having a participation of 1.28% in 2017, today already represent almost around 12% of the portfolio.

Torres said: “If we add up all the Dominicans who have received a pension or benefit from this System in these 21 years, more than 403 thousand people have been directly impacted.”

He stressed that personal savings is a challenge faced by all pension systems worldwide, whether they are pay-as-you-go or individually capitalized. Therefore, in order to promote voluntary savings so that members can achieve better pensions, SIPEN has already approved the regulatory framework that regulates complementary plans, one of the most recent innovations, which will allow independent workers and Dominicans residing abroad to join the pension system; which will also have its affiliation and contribution processes entirely through digital channels.

“We are betting that more Dominicans will soon begin to save for their future through more agile mechanisms and with better incentives for long-term savings,” he said.

He stressed that the Dominican pension system is stable, but with opportunities for improvement, on par with countries such as Spain and Colombia.