The rises experienced by the volatile price of intermediate oil from Texas (WTI) are putting the Dominican government in a bind, which this week may not be able to continue containing the increases in the internal price of fuels to users.

With a level that exceeds US$90 per barrel, nearly 48 percent higher than the average price calculated by the Government to design the 2022 Budget, continuing the policy of assuming debt with importers so as not to pass on the increases to final prices seems irresistible to the state.

Of the last three trading sessions, two have been of rises, placing Monday’s price above US$95.00 a barrel of crude oil on Tuesday. Yesterday, the price of Texas Intermediate Oil (WTI) closed with a decline of 3.55%, to 92.07 dollars a barrel, after the announcement that Russia has withdrawn part of the troops it had near Ukraine.

Implications

For the Dominican Government, the behavior could be a relief, if in today’s session crude oil continues to fall and is placed below or remains at the same level as that of Wednesday of last week. Wednesday is the last day of reference to calculate the average price that is used to calculate the prices that apply from each Saturday.

The price of crude oil has been at a higher level throughout the year than the average calculated by the Government in the General State Budget (PGE) 2022, which was US$62.70 a barrel. Yesterday’s close exceeded that projected average by almost US$30.00 a barrel.

Last Friday the Government continued to borrow from fuel importers to curb the rises in oil derivatives to consumers. For this week it assumed RD$600 million, with which it accumulates RD$2.5 billion so far this year.

The Ministry of Industry, Commerce and Mipymes (MICM) reported the new fiscal sacrifice assumed by the Government for the week of February 12 to 18, to keep the prices of all fuels unchanged. He reported that the Government assumed approximately 600 million pesos to “cushion the significant increases in the barrel of oil in the international market.” Meanwhile yesterday, according to data at the end of operations on the New York Mercantile Exchange (Nymex), WTI futures contracts for delivery in March lost 3.39 dollars compared to the previous close.

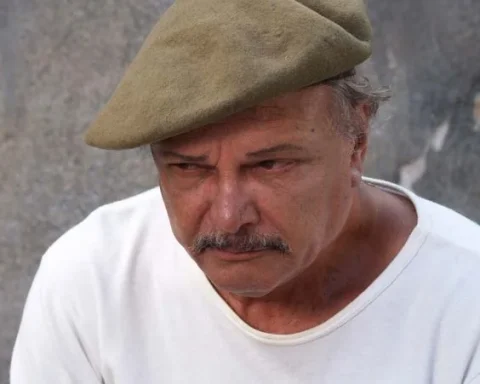

Ceara Hatton values yesterday’s loss as positive

The Minister of Economy, Planning and Development, Miguel Ceara Hatton, described as positive the decrease in oil prices in international markets that occurred yesterday, Tuesday. The economist and state official attributed the withdrawal of Russian troops from the border with Ukraine a decrease equivalent to 2 percent in crude oil prices, which leads to a price of 92 dollars a barrel.