Global shocks and structural changes reinforce the need to preserve solid macroeconomic fundamentals. This was one of the conclusions of the conference “Reconfiguring the Global Economy”, organized by the Central Reserve Bank of Peru (BCRP), the Reinventing Bretton Woods Committee (RBWC) and the Inter-American Development Bank (IDB), held on July 19 and 20 with the participation of international officials from the International Monetary Fund (IMF), the Federal Reserve of New York, the Bank for International Settlements (BIS), among others.

The global economy has weathered severe shocks such as the Global Financial Crisis, the COVID-19 pandemic, geopolitical tensions and rising inflation with relative success. However, several risks and challenges remain. Global risks include a slower convergence of inflation towards its target, high levels of public debt, climate change, additional disruptions in supply chains and fragmentation of global trade. Challenges include adapting to recent developments in Artificial Intelligence.

This environment of global shocks and accelerated structural changes reinforces the commitment of central banks to maintain control over inflation and inflation expectations. The experience presented at the conference reaffirms that central banks with greater credibility have reduced the impact of external shocks.

The strategies implemented by the region’s central banks to improve their payment systems were also highlighted. These strategies – which include the interconnection between various digital payment methods and central bank digital currency (CBDC) pilots – allow for increased financial inclusion, reduced transaction costs and increased speed of domestic and cross-border payments.

In terms of fiscal policy, reasonable levels of debt are required, particularly given the current high levels of international interest rates. This will be increasingly relevant, considering that mitigating the impact of climate change will require a substantial amount of resources, both public and private.

This environment entails risks, but also opportunities. For example, the fragmentation of trade could boost north-south trade and investment within the continent, particularly for those countries that, in addition to maintaining responsible macroeconomic management, have greater infrastructure development, an appropriate legal framework for investment and an environment of political stability.

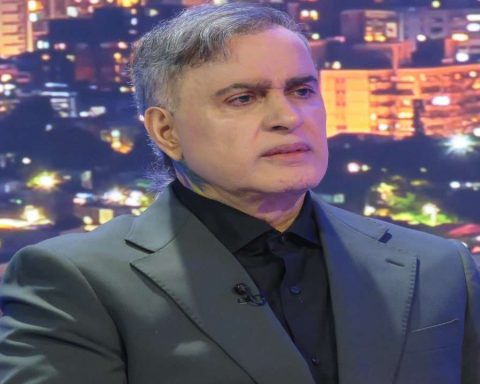

The event was opened by Julio Velarde, President of the BCRP, and Marc Uzan, Executive Director of the RBWC. The opening presentation was given by Gita Gopinath, First Deputy Managing Director of the IMF. Speakers included John Williams, President of the Federal Reserve Bank of New York, Andréa Maechler, Deputy Director General of the BIS, Alexandre Tombini, Chief Representative of the BIS Office for the Americas, Eric Parrado, Chief Economist of the IDB, José Darío Uribe, Executive President of the Latin American Reserve Fund (FLAR), and the presidents of the central banks of Chile, Colombia, Uruguay, Armenia, North Macedonia, and Portugal. Academics, such as Barry Eichengreen, and representatives of international financial institutions and research centers also participated.

Peru21 ePaper, enter here and try it for free.