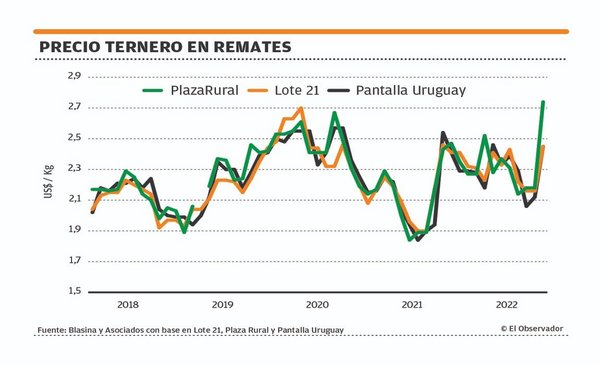

The cattle market is on. The raise that was missing for the replacement arrived, with calf price recordhand in hand with the rise in the value of fat cattle, a high export price for meat, a strong traction in international demand and – a key factor – the rains recorded since mid-January, which changed the face to the market.

This week at the auction of Plaza Rural the prices were historical for calves and the three categories of steers. The calves had never marked US$2.74 per kilo. They climbed almost 26% compared to the December auction. Compared to a year ago, in February 2021 calves had averaged $2.17.

For steers, the maximums were US$2.49 per kilo for those aged 1 to 2 years; US$ 2.45 for steers from 2 to 3; and US$2.43 for those over 3 years old.

The replacement reacted and reflects the confidence of the producer. The demand clearly exceeds the supply and just as for the fat man, the climatic-forage panorama gave a boost.

In cattle for slaughter, the intensity of industrial activity faces a supply that continues to shrink, as usually happens when the market is rising. And this turns to prices that climb and touch historical maximums reached in October of last year, of US$ 4.74 for steers. The poultry slaughter for now has no incidence.

This week the fat registered a substantial improvement compared to the previous week. For a batch of special, well-finished steers, US$ 4.80 per kilo can be reached, working batch by batch and with the industry asking “not to let cattle escape”.

There is a marked gap between good cattle and the top ones. Good fat steers go for $4.50 to $4.60.

In cows, well-weighted and quality carcasses have an important prize compared to more general lots, with a range that goes from US$4.20 to US$4.40, with carcass weight being key. For heifers, prices also vary strongly due to quality and finish, ranging from US$4.20 to US$4.50.

EO

The market is agile and highly demanded. Last week the slaughter was 53,951 cattle and in the first five weeks of the year it added 252,069 heads, 18% above 2021.

From the industry there is optimism about being able to reach this year the record of 2.6 million cattle slaughtered last year and it gives a sign of firmness.

International demand continues to push forward, with China buying at a good pace, the United States firm and Europe recovering in values.

This dynamic is reflected in the export price, which last week averaged US$4,777 per tonaccording to preliminary data from the National Meat Institute (INAC), and in the last four moving weeks reached US$ 4,869, all historically high values for Uruguay.

The annual accumulated shows a value of US$ 4,823, a jump of 29% compared to the same period in 2021 and 17% more than in 2020.

The panorama in sheep

In sheep, the drop in prices with which the year had started was halted and values are beginning to pick upwith lamb on the axis at US$4.11, lamb at US$3.87, capon at US$3.80 and sheep at US$3.60.

The slaughter was 25,822 sheep in the last week and remains above the previous year, with less participation of lambs and more sheep.

In sheep meat, the Average Export Index fell below US$ 5,000 per ton for the first time since the end of July last year. The average price last week was US$4,883, an adjustment possibly associated with a slowdown in China and with Brazil calmer. Even so, the accumulated annual average value is US$ 5,524, a recovery of 13% compared to the US$ 4,889 a year ago.

Everything remains firm for livestock.

john samuel

Firm values continue to dominate in the farm market.