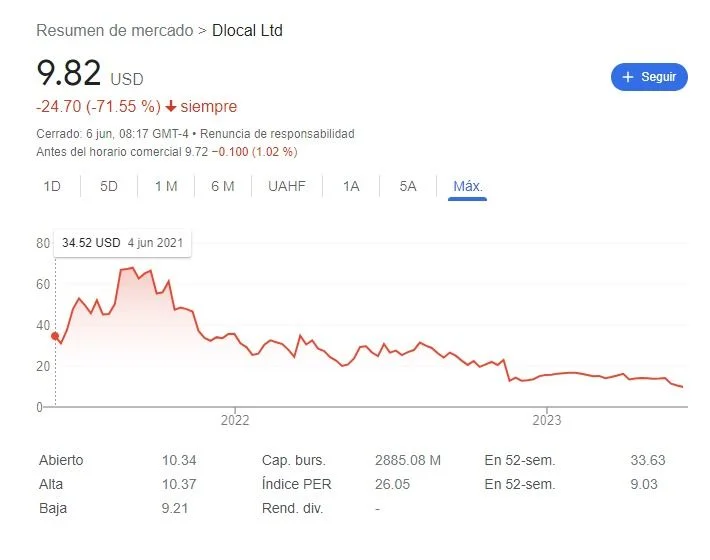

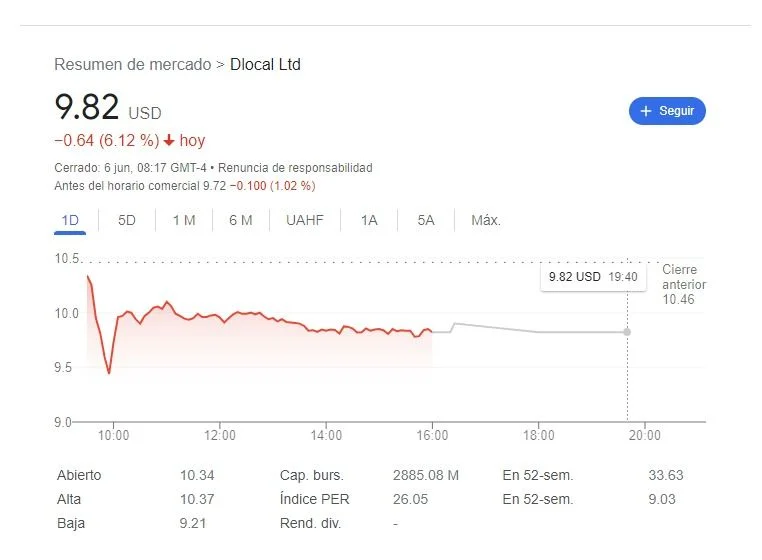

dLocal shares hit an all-time low on the morning of this Monday, June 5, after a drop that left them at US$9.73, although they increased in the afternoon and stood at US$9.82 at closing. This Tuesday, June 6, the share opened and remained around US$9.75.

The loss is a consequence of the imputation of the Argentine Justice to the Uruguayan company for possible money laundering maneuvers, reported days ago by Infobae and confirmed by The Observer.

This Tuesday, after opening at US$9.75, it moved to US$10.06, and after noon it was trading at around US$9.62.

google finance

In the last five days, the shares of the only Uruguayan “unicorn” – a company that reached a value of US$ 1,000 million worldwide – have had a drop of 16.14%.

The company provides a cross-border payments service, connecting large technology firms with emerging markets, and recently has been investigated by the Argentine government for overbilling of digital services and currency smugglingan action that involved a sum of at least US$400 million.

The maneuver of which dLocal is accused consisted of taking advantage of the exchange gap to send dollars abroad with operations that were not reflected in its accounting, avoiding the obligation to liquidate foreign currency from the export of services.

After the accusation, the Argentine Justice decided to study raising an official notice before the Securities and Exchange Commission, the United States stock market regulator.

Background

In November 2022 company shares fell 51% in a day at the New York Stock Exchange, after a critical report from the company of research and investment, Muddy Waters Capital, in which the Uruguayan firm was accused of “fraud”.

At that time, the shares were trading at US$10.29 and the company lost US$3.3 billion in market capital.

After that fact, Sergio Fogel, one of the founders of dLocal, clarified in dialogue with Coffee & Business: “A speculator published a report, we responded to him at the moment we thought appropriate and now each investor will draw the conclusions they should draw based on the reports we publish.”

Another drop in the shares, which occurred in March 2023, was as a result of a class action lawsuit that the international law firm of Bragar, Eagel and Squre PC started the company in the United States.